Warranty reserves for fab equipment can exceed $100M annually, making the architecture decision critical to your bottom line.

Semiconductor OEMs face a strategic choice: build custom warranty analytics in-house or adopt platform solutions. Hybrid approaches using API-first architectures deliver speed without lock-in, enabling customization of fraud detection and NFF analysis while leveraging pre-trained models for claims processing.

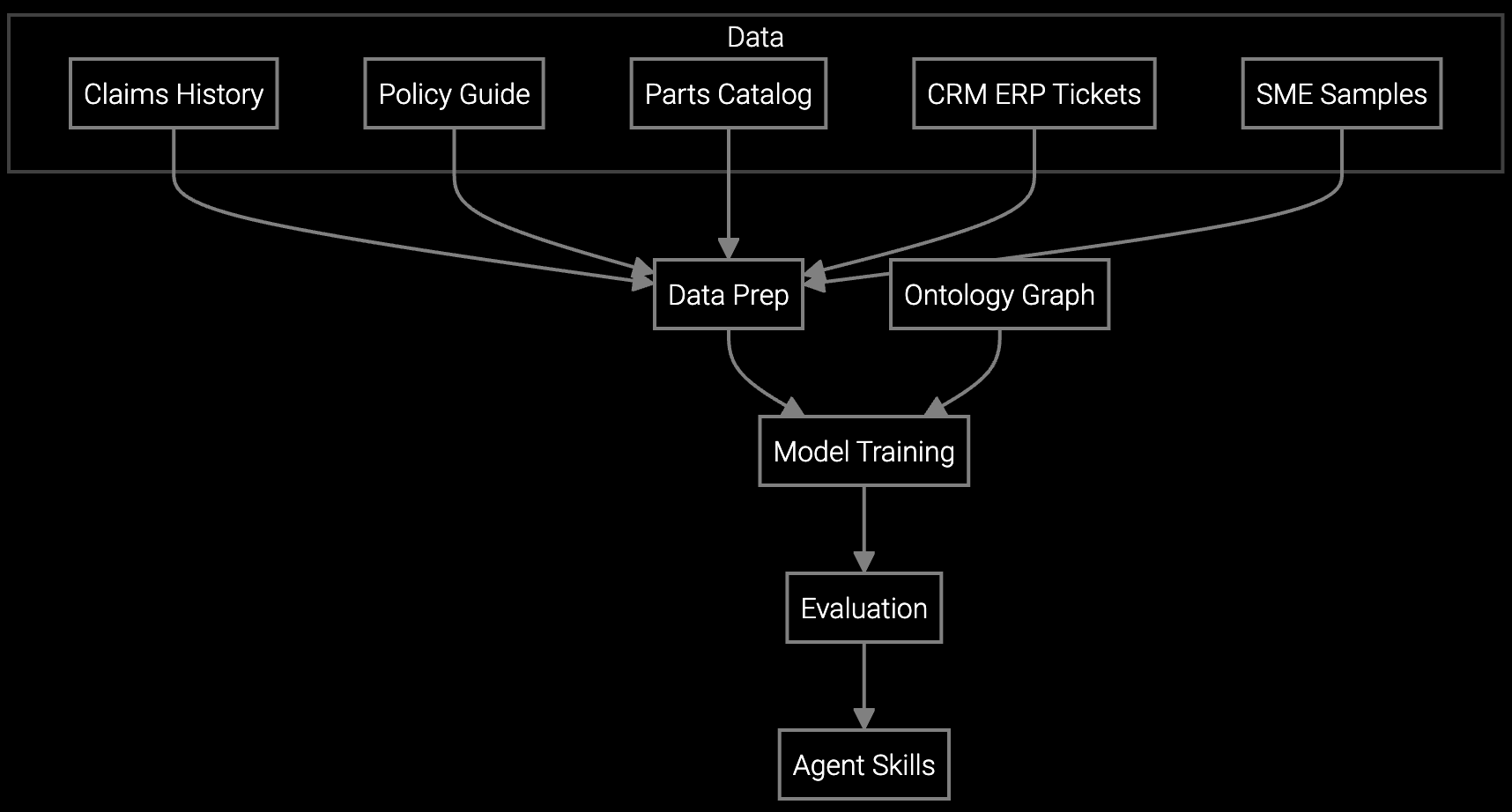

Building warranty analytics from scratch requires assembling training datasets, fine-tuning models, and creating custom integrations to SAP and Oracle systems. Most semiconductor OEMs underestimate the effort required to reach production-grade accuracy.

Traditional warranty management platforms force you into closed ecosystems with proprietary data formats. When fraud patterns shift or new claim types emerge, you wait for vendor roadmaps instead of adapting immediately.

Semiconductor warranty data lives across ERP systems, MES platforms, and fab data lakes. Any solution—built or bought—must connect to these sources without creating data silos or requiring complete system rewrites.

Bruviti's API-first platform resolves the build-versus-buy dilemma by combining pre-trained foundation models for common warranty tasks with full extensibility for semiconductor-specific requirements. Your team uses Python SDKs to customize fraud detection rules for high-value chamber components, adapt NFF prediction models to new product lines, and build custom entitlement verification flows—all without maintaining the underlying infrastructure.

The platform connects to existing data sources through standard REST APIs and supports both real-time and batch processing modes. When your warranty patterns evolve, you retrain models using your own labeled data while leveraging the foundation model's transfer learning capabilities. This approach delivers production-ready claims processing in weeks instead of months, with full control over business logic and zero vendor lock-in.

Automate failure mode classification for wafer-level defects using microscopy images, reducing manual review time for warranty claims validation on advanced lithography tools.

Automatically classify warranty claims by failure mode, component type, and root cause for semiconductor process equipment, enabling faster reserve allocation and accurate predictive modeling.

Semiconductor warranty costs scale with tool complexity and fab downtime impact. A single EUV lithography system failure can trigger warranty claims exceeding $500K when downtime costs are factored in. Your warranty strategy must account for multi-million dollar equipment portfolios, global installed bases across 200mm and 300mm fabs, and claim volumes that spike during technology node transitions.

The platform architecture you choose determines your ability to respond to these dynamics. API-first systems let you integrate real-time telemetry from process tools to predict component failures before they trigger warranty events. This predictive capability directly impacts warranty reserve accuracy and enables proactive parts replacement programs that reduce claim frequency while improving customer satisfaction.

Most semiconductor OEMs complete the initial integration in 6-8 weeks using standard REST APIs and pre-built connectors. The timeline depends on data quality in your existing warranty database and whether you need real-time or batch processing modes. Complex scenarios involving custom claim types or multi-tier approval workflows may extend to 10-12 weeks.

Yes. The platform provides Python SDKs for model customization using your labeled training data. You control the training pipeline, hyperparameters, and validation criteria while leveraging pre-trained foundation models for transfer learning. All training data remains in your environment, and you can export models for on-premise deployment if required by data governance policies.

The API-first architecture prevents lock-in through standard data export formats and open model architectures. You can export all training data, custom models, and integration code at any time. Many customers use the platform to accelerate initial deployment while building in-house expertise, then gradually shift more customization to their own teams using the same SDKs and APIs.

Process excursion claims require correlating warranty events with recipe changes, consumable batch numbers, and fab environmental conditions. API-first platforms excel here because you can build custom data pipelines that pull telemetry from MES systems and correlate it with claim data using your own business logic. Pre-built modules handle standard claims processing while your code addresses semiconductor-specific scenarios.

Core customization requires Python proficiency and familiarity with REST APIs. Advanced scenarios like custom NFF prediction models need data science skills for model training and validation. Most semiconductor OEMs assign 1-2 data engineers for initial integration and ongoing maintenance, with data scientists involved during model development phases for new claim types or failure modes.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Talk to our solutions architects about API-first warranty analytics for semiconductor equipment.

Schedule Technical Demo