Warranty reserve volatility now threatens margin stability as NFF rates climb and fab customers demand faster claim resolution.

Semiconductor OEMs face a strategic choice: build custom warranty AI internally or adopt a platform. Building offers control but requires 18+ months and specialized expertise. Buying delivers faster ROI but risks vendor lock-in. A hybrid API-first approach combines speed with customization flexibility.

CFOs struggle to forecast warranty reserves when claim patterns shift with each new product generation. EUV lithography systems and advanced etch tools introduce failure modes that historical models cannot predict, forcing conservative over-provisioning that depresses reported margins.

Returns without identifiable defects consume refurbishment capacity and erode trust with fab customers. When process engineers cannot isolate root cause on returned chamber components or metrology modules, the OEM absorbs both logistics costs and the risk of re-failure after reinstallation.

Fab downtime costs exceed one million dollars per hour. OEMs that resolve warranty claims faster gain competitive advantage in contract renewals and upsell opportunities. Manual entitlement verification and claim adjudication introduce delays that damage customer relationships and service revenue growth.

The build approach appeals to organizations with deep AI expertise and unique warranty workflows. Building internally grants full control over model architecture, training data governance, and integration with proprietary ERP and PLM systems. However, semiconductor warranty use cases demand specialized machine learning techniques for multimodal data—sensor telemetry, SEM images, failure codes, recipe parameters—that general-purpose data science teams lack experience deploying at production scale.

The buy approach accelerates deployment but introduces dependency risk. Traditional warranty software vendors offer limited AI capabilities, while pure-play AI platforms lack domain models trained on semiconductor failure modes. Bruviti's platform provides pre-trained models for entitlement verification, fraud detection, and NFF reduction while exposing APIs for custom rule integration and model fine-tuning. This hybrid strategy delivers production-ready capabilities in weeks while preserving strategic flexibility for differentiation.

AI analyzes microscopic images from returned semiconductor components to identify nanometer-scale defects, classify failure modes, and validate warranty claims with precision that manual inspection cannot match.

Automatically classifies warranty claims by failure mode, entitlement status, and refurbishment routing for etch tools, lithography systems, and metrology equipment—reducing manual processing time by 75%.

Semiconductor equipment warranty operations differ from other capital equipment sectors due to extreme downtime costs and complex failure interdependencies. A lithography tool failure may result from contamination in an upstream deposition chamber, making single-component warranty adjudication insufficient. Effective AI strategy must account for recipe parameter correlation, consumables traceability, and preventive maintenance history across tool sets.

Leading OEMs adopt a phased rollout beginning with high-volume, lower-complexity claims—chamber kit replacements, consumables validation, and duplicate claim detection. These early wins build organizational confidence and generate training data for more complex use cases like NFF root cause analysis and warranty fraud pattern detection. Integration with installed base management systems and customer portals maximizes value by closing the loop between warranty intelligence and service contract optimization.

Platform-based approaches typically show measurable warranty cost reduction within 90-120 days of deployment. The first wins come from automated entitlement verification and duplicate claim detection, which reduce processing costs immediately. More complex benefits like NFF reduction and fraud detection emerge over 6-9 months as models learn from your specific equipment failure patterns.

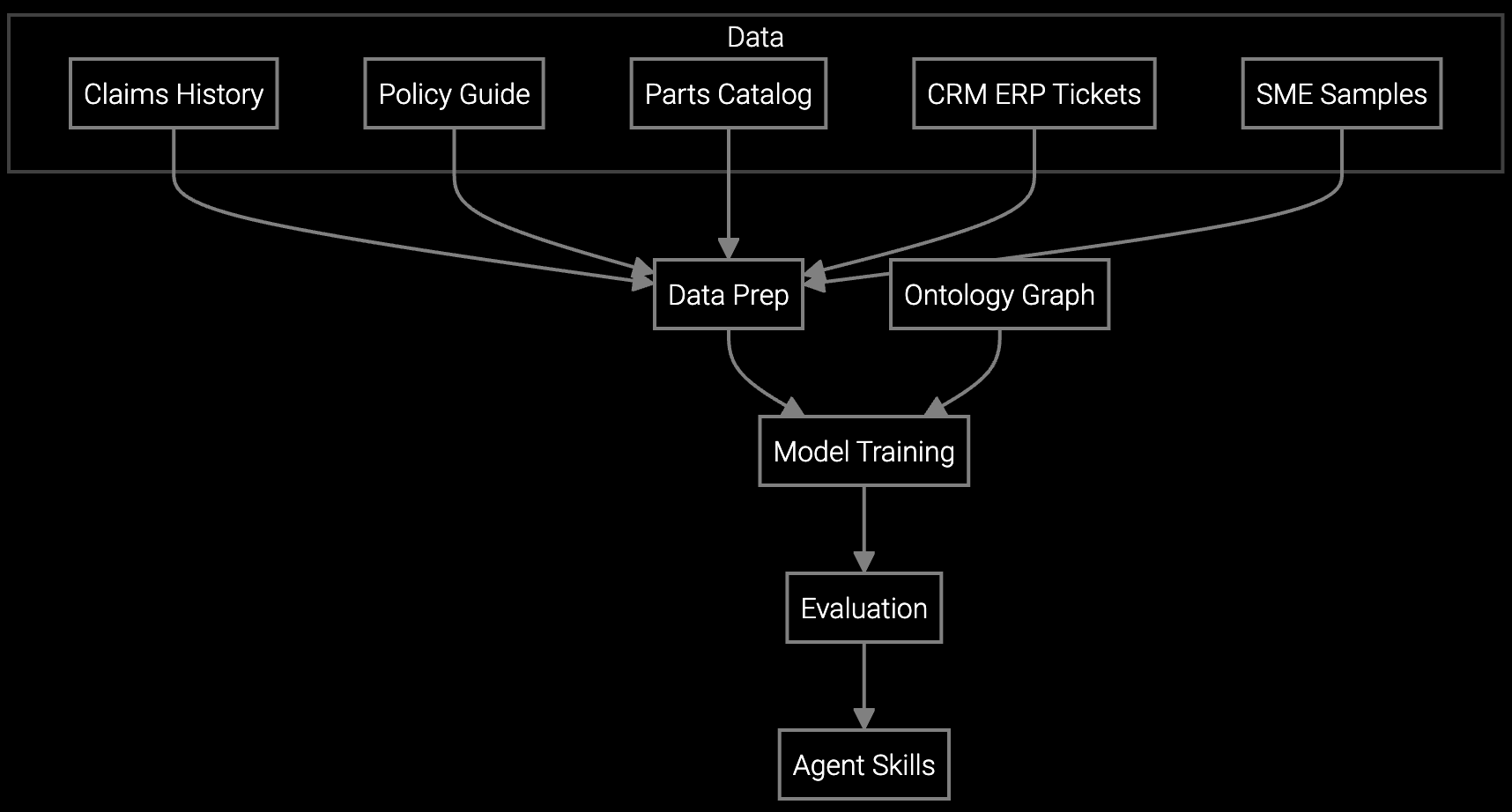

Modern warranty AI platforms work with existing data silos—ERP warranty modules, service ticketing systems, and customer portals. The platform ingests historical claims data, service records, and entitlement files through standard APIs. Advanced use cases benefit from sensor telemetry and diagnostic logs, but basic automation begins with structured claim records and product serial number mappings.

Semiconductor warranty requires multimodal AI that handles sensor time series, microscopic imagery, recipe parameters, and complex part hierarchies. Generic warranty software cannot process SEM images or correlate yield impact with component failures. Semiconductor-specific platforms include pre-trained models for chamber component degradation, contamination source detection, and preventive maintenance correlation that accelerate deployment versus building from scratch.

Success requires cross-functional alignment between warranty operations, service engineering, IT, and finance. A dedicated program manager coordinates deployment, but day-to-day operation relies on existing warranty analysts who configure business rules and review AI recommendations. Platform vendors provide initial model training and integration services, reducing the need for in-house data science teams.

API-first platforms like Bruviti enable custom model fine-tuning using your proprietary failure mode taxonomy and service knowledge base. You retain ownership of training data and model weights while benefiting from the vendor's pre-trained foundation models and infrastructure. This hybrid approach balances speed to value with strategic differentiation for warranty processes that deliver competitive advantage.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Bruviti's warranty experts will assess your build-versus-buy options and model ROI for your semiconductor equipment portfolio.

Schedule Strategic Assessment