Rising RMA volumes and warranty reserve pressure demand AI-driven decision-making—but the wrong implementation path costs 18 months and millions.

Network OEMs face a strategic choice: build custom warranty AI requiring 18-24 months and specialized talent, buy rigid vendor solutions with lock-in risk, or adopt API-first platforms that combine pre-built models with full extensibility to reduce NFF rates and warranty reserves faster.

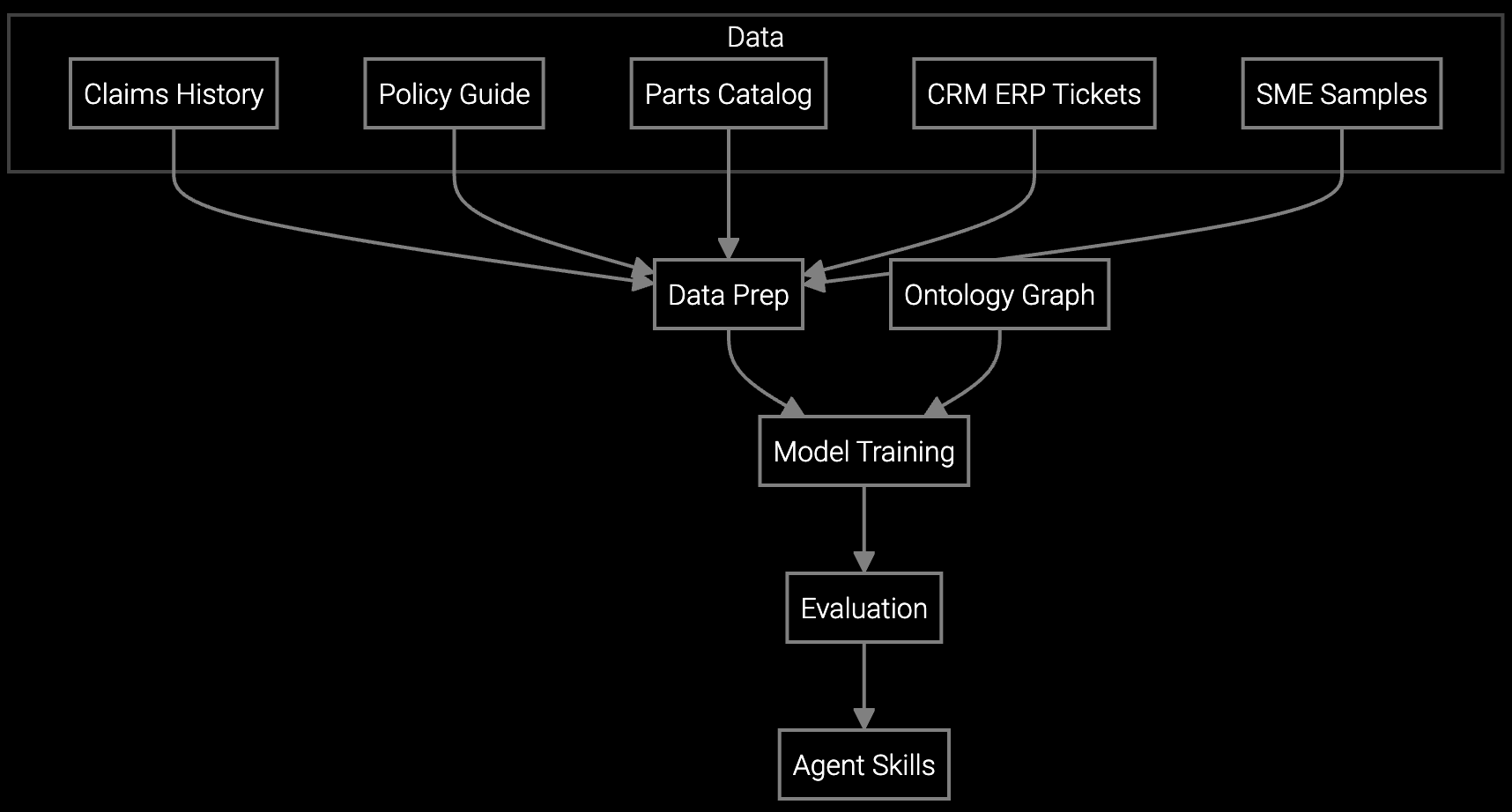

In-house warranty AI development requires scarce ML engineers, access to clean historical RMA data, and continuous model maintenance. Most network OEMs underestimate the infrastructure costs and talent competition.

Traditional warranty management vendors offer bundled AI features with proprietary integrations. Switching costs escalate as claim workflows become embedded in vendor-specific schemas and workflows.

Every quarter without AI-driven fraud detection and NFF prediction extends warranty reserve accruals. For network OEMs with installed bases exceeding 100,000 units, delays translate directly to margin erosion.

Bruviti's platform resolves the build-versus-buy dilemma by delivering pre-trained warranty models that deploy in weeks while preserving full API access for custom extensions. Network OEMs gain immediate fraud detection and NFF prediction without sacrificing control over proprietary claim logic or entitlement rules.

The architecture separates model inference from business logic, allowing your team to modify claim validation workflows, integrate with existing ERP systems, and export training data without vendor approval. This eliminates lock-in risk while accelerating time to value—deploying core capabilities in 6-8 weeks instead of 18 months.

Automatically classify and code warranty claims for routers, switches, and optical transport equipment, reducing manual processing time and improving entitlement accuracy across global RMA centers.

AI analyzes microscopic failure images from returned network ASICs and optical components, validating warranty claims with objective defect classification and reducing disputed returns.

Network equipment warranty exposure differs fundamentally from consumer devices. With average router and switch lifespans of 7-10 years, firmware-driven failure modes, and mission-critical uptime SLAs, warranty costs compound over extended service contracts. A single miscoded RMA for a carrier-grade chassis can cost $50K-$150K in unnecessary logistics and refurbishment.

Network OEMs also face unique fraud patterns: customers replacing functional units under warranty to refresh inventory, returning units with configuration errors misdiagnosed as hardware failures, and submitting claims for equipment past EOL dates. Traditional rule-based systems cannot detect these patterns at scale across product portfolios spanning routing, switching, wireless, and optical transport.

Network OEMs typically see measurable warranty reserve reduction within 6-9 months of deployment, with full ROI achieved in 12-18 months. Early wins come from fraud detection and NFF reduction on high-volume product lines like enterprise switches and routers. The key is selecting a deployment approach that minimizes time-to-value—pre-built models accelerate payback versus custom development.

Bruviti's architecture separates AI model inference from business logic through open REST APIs and standard data schemas. You retain full control over claim validation rules, entitlement verification workflows, and training data. All integrations use industry-standard protocols, allowing seamless migration or parallel deployment with existing warranty systems. Unlike monolithic vendors, there are no proprietary data formats or closed ecosystems.

Bruviti's platform requires no in-house ML expertise for initial deployment. Your warranty operations team configures claim workflows through a visual interface, while IT handles standard API integrations. Model retraining and performance monitoring are automated. For custom extensions, basic Python knowledge enables advanced customization—but this is optional, not required for core functionality.

Yes, if historical RMA data exists for those product lines. The platform trains on past claim patterns, failure codes, and resolution outcomes regardless of equipment age. For legacy products with sparse data, transfer learning from similar product families fills gaps. Network OEMs with 10+ years of RMA history across routers, switches, and optical systems see strong model accuracy even for EOL equipment.

Start with a pilot at your highest-volume RMA center focusing on one product category like enterprise switches. Run parallel processing for 60 days to validate AI recommendations against manual adjudication. Once accuracy thresholds are met, expand to additional product lines at the same facility, then replicate the model to regional RMA centers. This phased approach minimizes risk while building internal confidence.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Schedule a 30-minute assessment to map your current warranty costs, NFF patterns, and deployment timeline options.

Schedule Strategy Session