Senior technicians retiring with decades of network troubleshooting expertise creates an urgent window to capture knowledge before it walks out the door.

Network equipment OEMs reduce first-time fix costs 40% faster by partnering with AI platforms that ingest existing telemetry and tribal knowledge, versus building in-house solutions that require 18+ months and specialized data science teams to achieve comparable technician effectiveness.

Network OEMs lose senior technicians who can diagnose DWDM optical issues or carrier-grade routing failures by reading error logs. Building AI to replicate this expertise requires capturing knowledge before retirement, not after.

Every repeat truck roll to a carrier NOC or remote cell site erodes service margin. OEMs delay AI deployment while building in-house solutions, extending the window of high truck roll costs and SLA penalty exposure.

Five-nines availability means network downtime directly impacts business operations. Building diagnostic AI from scratch delays deployment of predictive failure detection that prevents customer-impacting outages.

Network equipment OEMs face a build-versus-buy decision that hinges on speed to value and margin protection. Building in-house AI requires assembling specialized data science teams, developing models that understand SNMP traps and syslog patterns, and training algorithms on years of field service data. This approach delivers control but delays ROI by 18-24 months while truck roll costs and expertise loss continue.

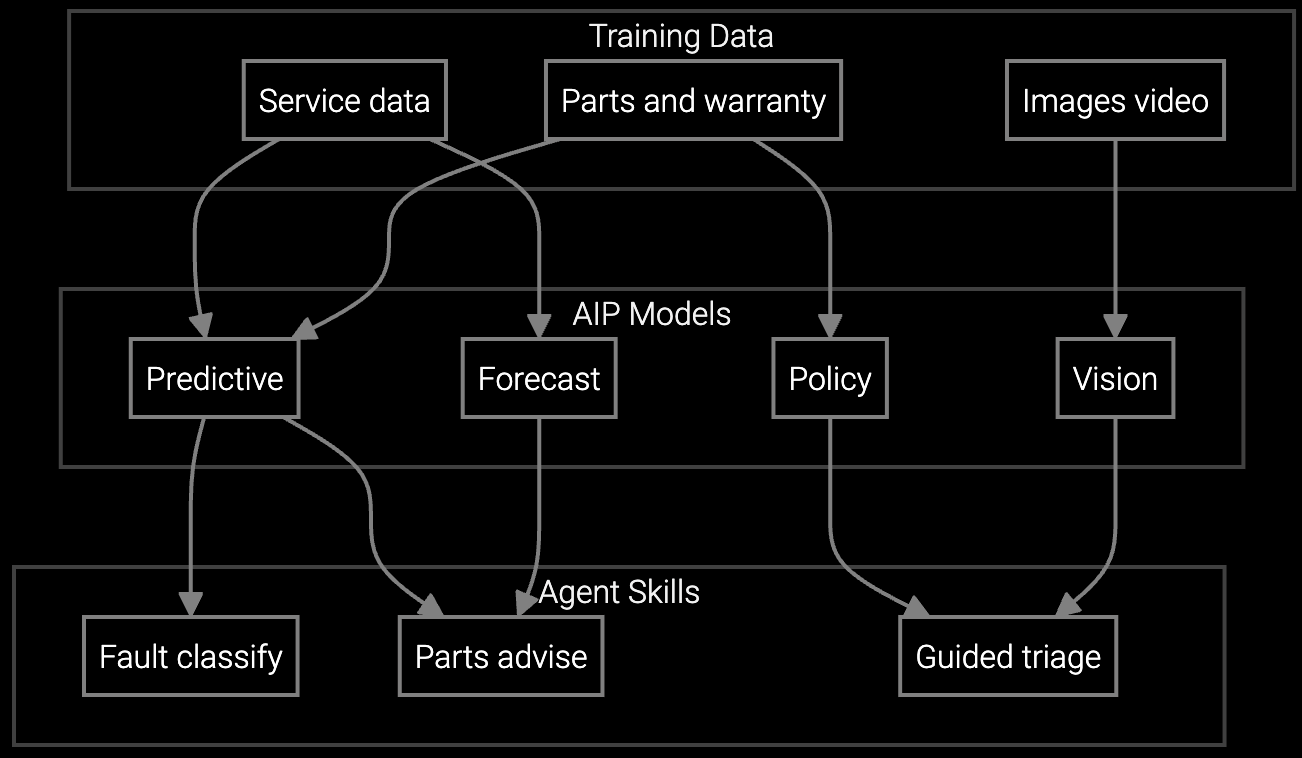

Bruviti's platform ingests existing telemetry streams, service tickets, and tribal knowledge without requiring in-house model development. Network OEMs connect their NOC data feeds, historical RMA records, and technician debrief notes. The platform learns routing failure patterns, firmware vulnerability signatures, and PoE power anomalies from day one, accelerating first-time fix rates within 90 days versus waiting two years for internal AI competence.

Predicts which line cards, power supplies, or optical transceivers technicians will need before dispatch to carrier NOCs, reducing repeat visits for missing parts at remote sites.

Correlates SNMP trap patterns and error logs with historical DWDM optical failures and routing anomalies, replicating senior technician diagnostic expertise.

Mobile copilot provides firmware rollback procedures, configuration validation scripts, and optical power troubleshooting guidance on-site at carrier NOCs and cell towers.

Network equipment manufacturers face unique AI strategy challenges. Carrier-grade routers and 5G infrastructure generate high-velocity telemetry streams—SNMP traps, syslog events, optical power readings—that require domain-specific AI models to interpret. Building these models in-house means hiring data scientists who understand BGP routing failures and DWDM optical anomalies, a rare skill combination that extends hiring timelines by months.

Platform approaches accelerate deployment by pre-training models on network equipment failure patterns. OEMs connect existing NOC monitoring tools and RMA databases without building data pipelines from scratch. The platform learns which syslog patterns precede line card failures or which firmware versions correlate with PoE power issues, replicating the diagnostic judgment retiring senior technicians bring to complex carrier network outages.

Network equipment OEMs building field service AI in-house typically require 18-24 months to achieve production-ready diagnostic models. This timeline includes hiring specialized data scientists, building data pipelines to ingest SNMP and syslog streams, training models on historical failure patterns, and validating accuracy with field technicians. Platform approaches reduce this timeline to 90-120 days by pre-training models on network equipment telemetry patterns.

Building in-house requires $2-3M annually in data science salaries, infrastructure costs, and model training compute. Platform partnerships typically cost $200-400K annually with faster ROI due to immediate deployment. The break-even analysis favors platforms when time-to-value matters—every quarter delayed extends high truck roll costs and expertise loss risk that erode service margins.

Yes. Platforms like Bruviti ingest network-specific telemetry including SNMP traps, syslog error codes, optical power measurements, and firmware version data. The platform learns correlations between signal degradation patterns and line card failures, or between BGP route flaps and configuration errors, by analyzing historical RMA records and technician debrief notes. This domain specificity replicates senior technician diagnostic expertise without requiring OEMs to build models from scratch.

Platforms accelerate knowledge capture by ingesting technician debrief notes, service ticket resolutions, and diagnostic decision trees. Senior technicians document their troubleshooting logic as they resolve complex carrier network outages. The AI learns which diagnostic steps senior technicians prioritize when diagnosing PoE power issues versus routing failures, preserving this expertise before retirement. Building in-house delays this capture by 18+ months while expertise walks out the door.

Successful network OEMs pilot AI on high-cost failure scenarios like carrier-grade routing failures or 5G cell site outages where truck roll costs exceed $3,000 per incident. They integrate NOC monitoring telemetry first to enable predictive failure detection, then expand to parts prediction and mobile technician guidance. This phased approach delivers measurable first-time fix improvement within 6 months while minimizing change management risk across the field service organization.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

Discover how Bruviti deploys field service AI in 90 days without requiring in-house data science teams.

Schedule Strategy Session