24/7 uptime demands require proven AI—not science projects that ship answers while your NOC waits.

Network OEMs gain faster time-to-value with platform approaches that combine pre-trained service models with API-first customization. This hybrid strategy delivers quick wins on case triage and knowledge retrieval while preserving integration control—avoiding both the 18-month build cycles of in-house development and the rigid workflows of traditional contact center software.

In-house AI development for contact centers consumes specialized data science talent and infrastructure investment before delivering value. Network OEMs face opportunity cost when engineers build internal tools instead of shipping product features.

Traditional contact center platforms lock OEMs into rigid workflows that don't accommodate network equipment complexity. Vendor roadmaps control when critical features ship, creating dependency on external release cycles.

Network equipment customers expect instant resolution and proactive support. OEMs that wait 18 months for internal AI or settle for generic vendor tools lose market position to competitors shipping AI-powered service experiences now.

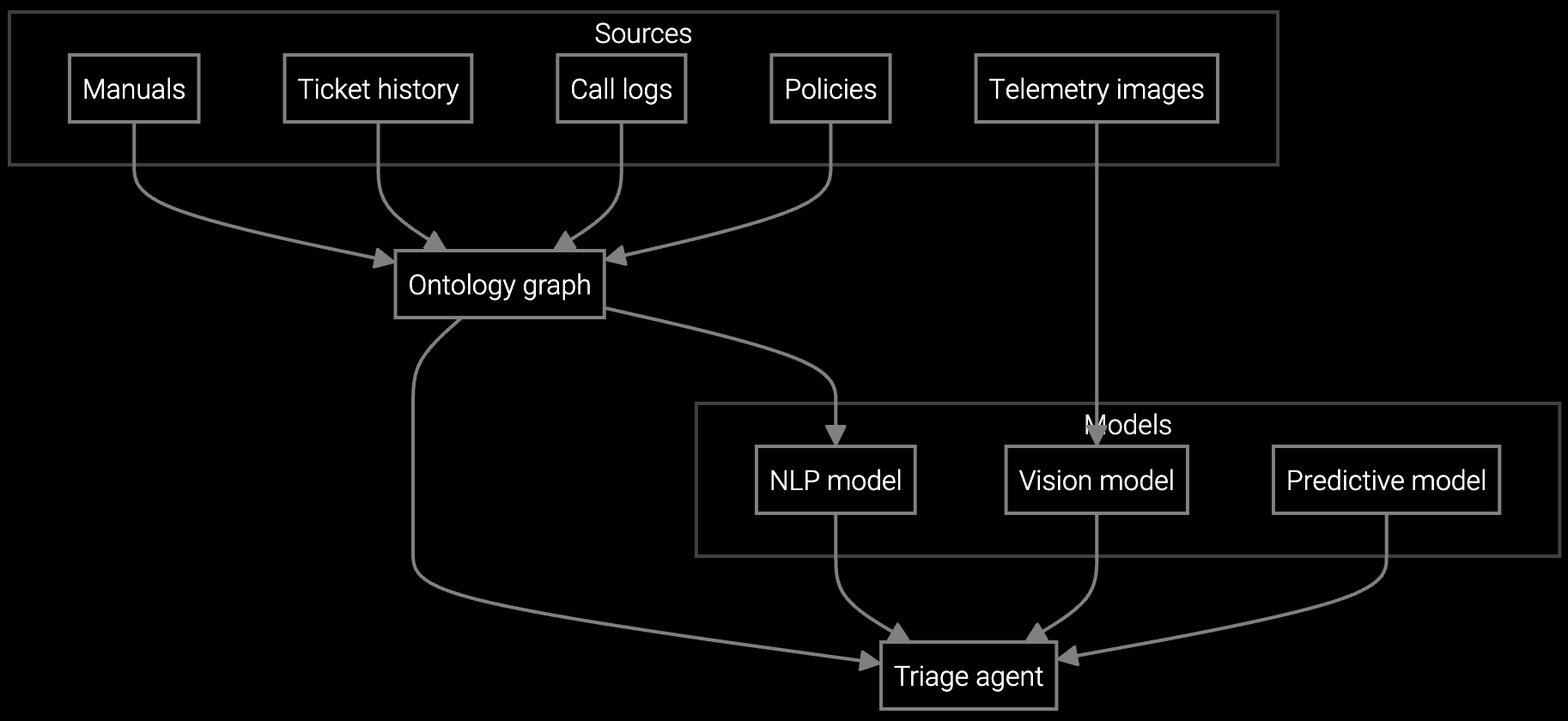

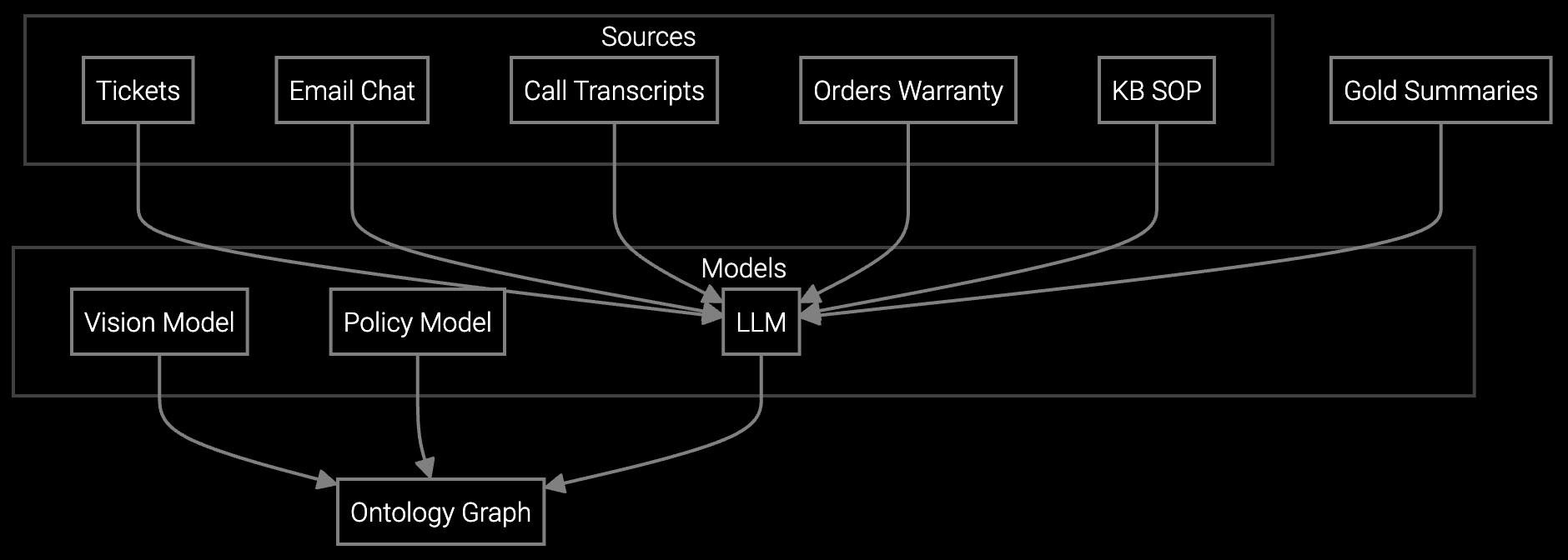

Bruviti delivers a third path: pre-trained service models combined with API-first customization. The platform ingests network equipment telemetry, syslog streams, and historical case data to classify issues and recommend resolutions—trained on patterns across the network equipment industry. This eliminates the cold-start problem that delays internal builds.

Unlike monolithic contact center suites, the platform exposes every capability through APIs. OEMs integrate case classification into existing CRM workflows, pipe recommended responses to agent copilots, or automate email triage without replacing infrastructure. Teams customize model behavior, add proprietary logic, and maintain control over the service experience—without managing GPU clusters or hiring ML specialists.

Classify network equipment cases from SNMP traps, syslog patterns, and symptom descriptions—routing firmware issues to software engineers and hardware failures to RMA processing without manual review.

Generate instant summaries of escalated network outage cases, consolidating email threads, chat logs, and NOC notes so senior engineers understand the full context in seconds instead of 15 minutes.

Automate responses to routine firmware upgrade questions and configuration queries by matching customer emails to knowledge base articles—reducing agent workload by 30% while maintaining response quality.

Network equipment support combines high technical complexity with 24/7 uptime expectations. Routers, switches, and firewalls generate rich telemetry streams—SNMP traps, syslog events, error counters—that traditional contact center tools ignore. Generic AI can't distinguish a firmware bug from a configuration error or a failing power supply.

Network OEMs need platforms trained on equipment-specific failure patterns while maintaining integration flexibility for multi-vendor NOC environments. The hybrid approach delivers both: pre-built models that understand network equipment behavior, plus APIs that pipe insights into existing ServiceNow, Salesforce, or custom CRM workflows without forcing a rip-and-replace migration.

Platform-based approaches typically deploy in 8-12 weeks from kickoff to production, including data integration, model training on historical cases, and agent workflow integration. This contrasts with 18+ month timelines for in-house development, which require building infrastructure, hiring ML talent, and training models from scratch.

Internal builds typically require $800K-$1.2M in first-year investment covering data science team salaries, GPU infrastructure, and engineering time—before delivering value. Platform approaches start at $150K-$300K annually with immediate functionality. The break-even calculation favors platforms unless OEMs need highly specialized capabilities unavailable in any commercial offering.

Evaluate platform architecture for API-first design, data portability, and integration flexibility. The platform should expose classification, recommendation, and automation capabilities through REST APIs that integrate with existing systems rather than requiring wholesale CRM replacement. Request proof of data export capabilities and review contract terms for transition rights.

Pre-trained platforms built for technical equipment support ingest structured telemetry alongside unstructured case text. The platform learns to correlate syslog patterns, SNMP trap sequences, and symptom descriptions to identify firmware bugs versus configuration errors. This domain specificity distinguishes technical support platforms from generic contact center AI trained only on retail or SaaS support data.

Track cost per contact, average handle time (AHT), first contact resolution (FCR), and CSAT scores before and after deployment. Network OEMs typically see 25-35% cost per contact reduction, 20-30% AHT improvement, and 10-15 point CSAT gains within 6 months. Measure deflection of cases that would have required senior engineer escalation or truck rolls.

Transforming appliance support with AI-powered resolution.

Understanding and optimizing the issue resolution curve.

Vision AI solutions for EV charging support.

See how network equipment OEMs deploy contact center AI in weeks, not years—without vendor lock-in.

Schedule Strategy Session