When router failures spike during peak deployment cycles, missing power supplies cost you SLA penalties and customer trust.

Network OEMs solve critical parts stockouts by combining install base telemetry with failure pattern analysis to predict demand weeks ahead, dynamically rebalancing inventory across regional warehouses, and maintaining just-in-time availability for high-velocity components while reducing carrying costs on slow-moving parts.

When a carrier-grade router fails and the replacement line card isn't available locally, overnight freight erases your margin. Multiply this across hundreds of RMAs monthly and emergency shipping becomes a seven-figure problem.

Network downtime is measured in lost revenue per minute for your customers. When parts aren't available to meet contracted repair times, SLA penalties and customer churn compound the financial impact beyond the immediate service cost.

Overcompensating for stockouts by holding deep safety stock creates a different problem. Firmware updates can obsolete hardware revisions overnight, and EOL announcements leave you holding inventory you can't deploy and can't return.

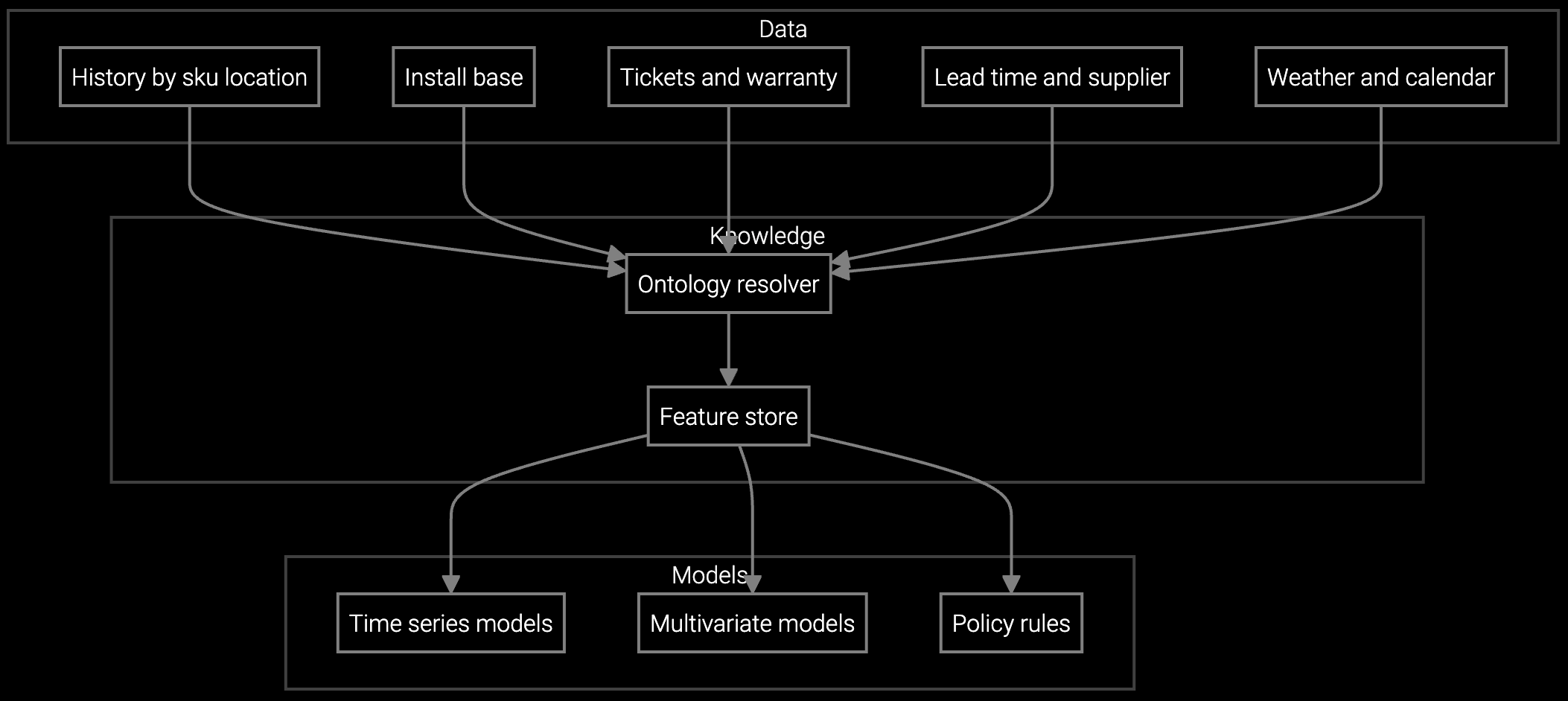

Bruviti's platform ingests telemetry from your installed base of routers, switches, and wireless infrastructure to detect failure signatures weeks before they trigger RMAs. Power supply voltage drift, fan speed anomalies, and memory error rates become leading indicators that shift demand forecasts from reactive to predictive.

The system learns seasonal patterns specific to network equipment—5G buildout cycles, campus refresh projects, data center expansions—and adjusts inventory positioning accordingly. When firmware vulnerability patches drive planned hardware swaps, the AI routes additional stock to high-impact regions before service orders arrive. This predictive positioning cuts emergency shipping costs while maintaining fill rates above 95% for critical line cards and power modules.

Forecast router component demand by region and time window based on install base age and telemetry patterns, optimizing stock levels while avoiding costly expedited shipments.

Project line card and power supply consumption using install base demographics, firmware update schedules, and seasonal deployment cycles to maintain optimal inventory turns.

Enable field service partners to photograph failed transceivers or modules for instant part number identification and availability confirmation, reducing quote turnaround time.

Network equipment generates rich telemetry streams—SNMP traps, syslog data, environmental sensor readings—that most OEMs route to NOC dashboards but don't connect to inventory planning. The platform bridges this gap by correlating log patterns with historical failure modes. When a batch of switch power supplies shows elevated ripple voltage, the AI flags affected serial numbers and triggers proactive stock replenishment for replacement units in regions with high concentrations of at-risk devices.

For carrier-grade equipment with 99.999% uptime SLAs, even a 2-hour parts delay generates six-figure penalties. The system identifies which line cards and transceivers are most SLA-critical based on your contract portfolio, then applies tighter availability constraints to those SKUs. This ensures you're not treating every component equally—business impact drives stocking priorities, not just volume or cost.

The platform applies failure rate curves from similar product families and adjusts based on component-level MTBF data from your engineering specifications. As new telemetry accumulates, device-specific models replace the initial estimates. Early-life firmware issues often drive demand spikes that the AI detects from log patterns before they appear in RMA volumes.

Bruviti customers typically reduce expedited shipping costs by 30-40% within the first quarter by pre-positioning inventory based on predicted demand. Inventory carrying cost reductions of 15-25% follow as safety stock levels are optimized per SKU rather than set uniformly. SLA penalty avoidance delivers additional six-figure value for carrier-facing OEMs.

The platform tracks your firmware release roadmap and EOL announcements, then flags inventory at risk of obsolescence. When a security patch requires hardware replacement rather than an update, the AI adjusts demand forecasts to consume at-risk stock before the cutover date. This prevents write-offs while maintaining service continuity.

Yes. The system learns that wireless access point failures spike during summer heat in southern regions, while optical transport equipment shows higher winter failure rates in northern climates. Carrier-grade router demand follows metro fiber buildout cycles, while enterprise switches align with campus refresh schedules. These patterns drive region-specific stocking strategies.

Typical integration timelines run 4-6 weeks for SNMP and syslog feeds, with ERP connectors for SAP or Oracle adding 2-3 weeks. The platform provides pre-built adapters for common network management systems and inventory platforms, minimizing custom integration work. Pilot deployments often focus on a single high-value product line to demonstrate ROI before full-scale rollout.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how network equipment OEMs use Bruviti to predict parts demand and protect margins.

Schedule Executive Briefing