Thin margins and high-volume claims make strategic platform choices existential for appliance OEMs competing on service cost.

Appliance OEMs choose hybrid approaches combining vendor platforms for speed with API extensibility for control. Pre-built claim validation and fraud detection models deliver immediate NFF reduction while custom integrations preserve warranty system investments and enable phased deployment without operational disruption.

Building warranty AI in-house requires hiring scarce ML talent, acquiring training data, and maintaining infrastructure. Most appliance OEMs lack the scale to justify dedicated teams when warranty costs represent single-digit percentage of revenue.

Traditional warranty software vendors offer closed ecosystems that trap data and prevent integration with existing ERP, CRM, and logistics systems. Switching costs and data portability challenges make exit prohibitively expensive.

Pure-build strategies miss near-term margin protection opportunities as NFF rates climb and warranty reserves expand. Waiting for homegrown solutions costs millions in preventable warranty expenses while competitors deploy faster.

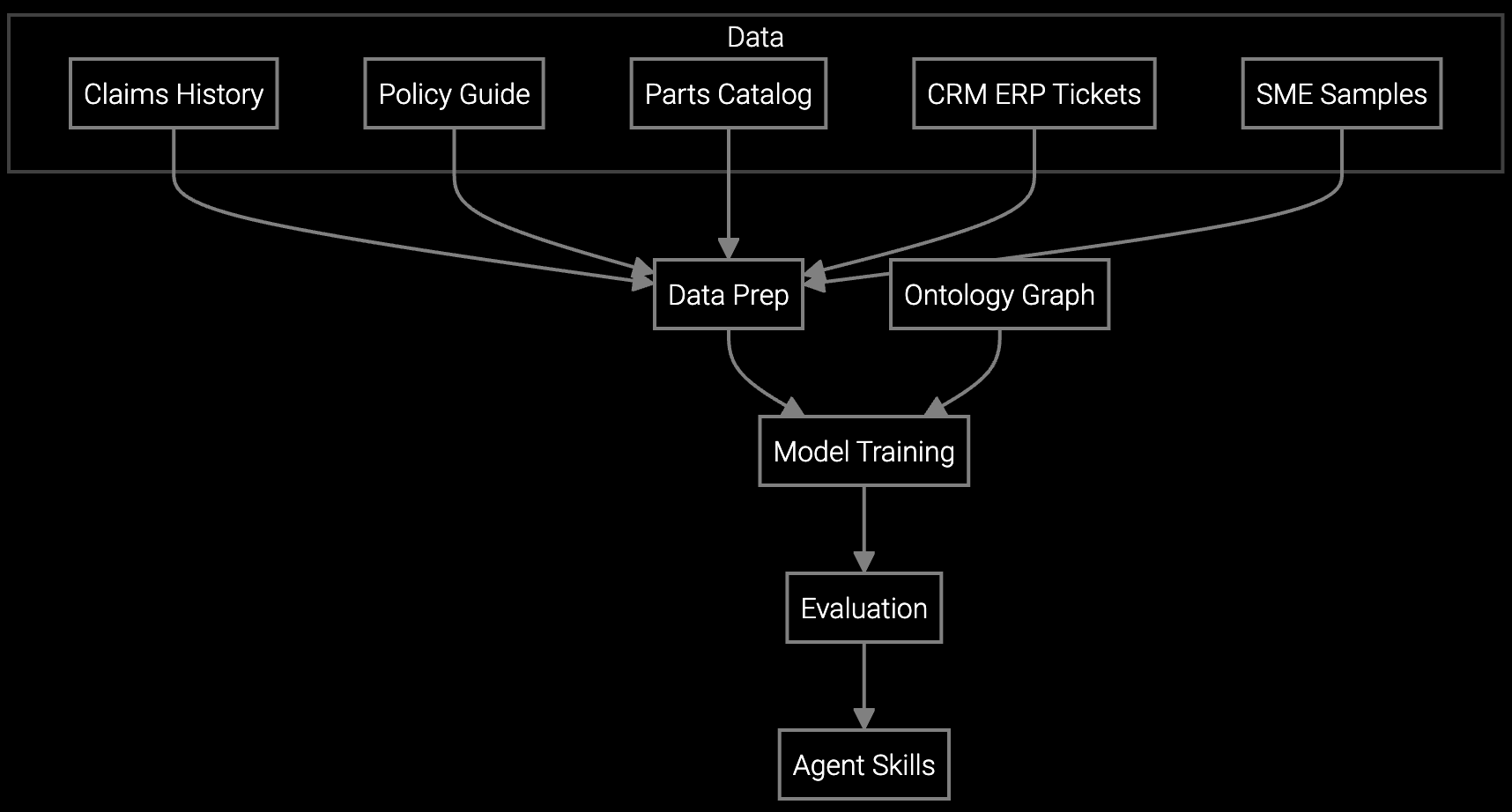

Appliance manufacturers resolve the build-buy dilemma through platforms that combine immediate deployment with architectural control. Bruviti delivers pre-trained models for claim validation, fraud detection, and entitlement verification that reduce NFF rates within weeks while exposing APIs for custom workflow integration.

The platform ingests warranty claims from existing systems via standard connectors, applies AI validation logic, and returns structured decisions through RESTful APIs. This preserves investments in SAP Warranty Management, Salesforce Service Cloud, or proprietary systems while adding intelligence at the decision layer. Phased rollouts start with high-volume product lines like refrigerators and washers before expanding to HVAC and small appliances, minimizing change management risk and proving ROI incrementally.

Validate warranty claims for refrigeration compressors and heating elements by analyzing microscopic failure signatures, reducing fraudulent returns.

Automatically classify claims across appliance product lines, ensuring consistent coding and accelerating processing for high-volume seasonal spikes.

Appliance manufacturers face unique constraints that shape AI adoption strategy. Thin margins in major appliances require rapid ROI, while seasonal demand spikes for HVAC and refrigeration products create capacity planning challenges. Connected appliances generate telemetry data that enables predictive warranty interventions, but legacy product lines lack IoT connectivity.

Successful implementations start with high-volume, low-margin product categories where NFF reduction delivers immediate savings. Refrigerators and washing machines represent the largest claim volumes and benefit most from AI-driven entitlement verification and symptom analysis. HVAC systems follow once models prove accuracy during peak cooling and heating seasons. The platform integrates with dealer networks and authorized service centers to streamline RMA processing while maintaining quality control.

Most appliance manufacturers lack the scale and ML expertise to justify building warranty AI from scratch. Pure-build strategies require 18-24 months and dedicated data science teams, delaying margin protection. Hybrid platforms deliver pre-trained models immediately while allowing custom integrations through APIs, eliminating the build-buy trade-off.

API-first architectures expose all functionality through standard interfaces, enabling data portability and preventing proprietary lock-in. The platform integrates with existing warranty systems rather than replacing them, preserving investments in SAP, Salesforce, or custom tools. Open APIs allow switching providers without re-implementation if business needs change.

Start with high-volume, low-margin categories like refrigerators and washing machines where NFF reduction delivers immediate ROI. These products generate sufficient claim volumes to train models quickly while representing material warranty costs. Success in major appliances builds confidence before expanding to HVAC systems and small appliances.

Platform-based approaches deploy claim validation and fraud detection in 6-8 weeks using pre-trained models adapted to appliance failure modes. Custom workflow integrations with existing warranty systems add 4-6 weeks. Phased rollouts by product line allow proving value incrementally versus big-bang implementations.

Typical deployments reduce NFF rates by 20-30% and detect 15-25% more fraudulent claims, translating to $2-4M in annual savings for mid-size manufacturers. Faster claim processing reduces administrative costs by 30-40%. Most implementations achieve payback within 9-12 months, with ongoing margin protection as volumes scale.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

Discover how leading appliance manufacturers deploy AI to protect margins without build risk or vendor lock-in.

Schedule Strategy Session