Legacy equipment lifecycles demand inventory systems that adapt faster than custom builds—but won't lock you into rigid vendor platforms.

Industrial OEMs should adopt API-first platforms that combine pre-built demand forecasting with custom integrations, enabling faster deployment than building from scratch while avoiding vendor lock-in from rigid solutions.

Building demand forecasting from scratch takes 18-24 months while parts obsolescence accelerates. By the time your ML team trains models, equipment lifecycles have shifted and stockout patterns have changed.

Monolithic inventory platforms don't connect to your SAP instance, field service system, or warranty database. Every new integration requires vendor roadmap prioritization instead of your development schedule.

Off-the-shelf forecasting assumes consistent failure rates. Your 20-year-old CNC machines and 15-year-old compressors have unique degradation curves that generic algorithms miss entirely.

Bruviti's API-first platform delivers pre-built demand forecasting, substitute matching, and inventory optimization that deploys in weeks—not years. You get immediate value from models trained on industrial equipment failure patterns while maintaining full control through open APIs.

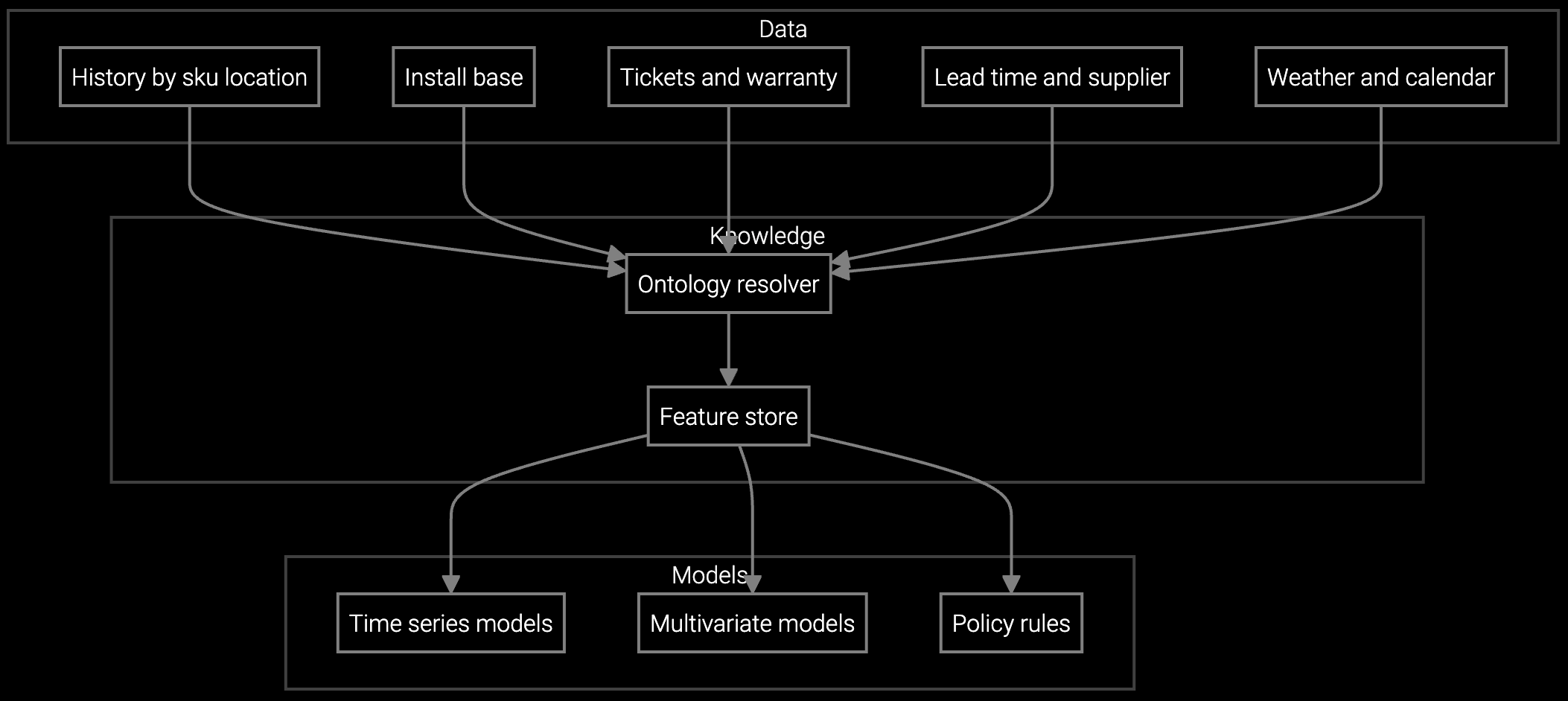

The platform ingests data from your existing ERP, CMMS, and telemetry systems without requiring migration. When you need custom logic for aging equipment or regional warehouse rules, your team extends the platform through documented APIs instead of waiting on vendor roadmaps.

Projects parts consumption for aging industrial machinery based on run hours, maintenance cycles, and seasonal production patterns.

Optimizes stock levels across regional warehouses by forecasting demand windows for critical compressor and turbine components.

Snap a photo of worn machine tool components to instantly get part numbers and substitute availability, eliminating manual catalog searches.

Industrial equipment OEMs support machinery deployed 10-30 years ago—CNC machines from the early 2000s, compressors from the 1990s, turbines still running after decades. Standard inventory models assume stable failure rates and consistent supply chains. They break down when faced with parts obsolescence, supplier consolidation, and equipment that outlasts its original service documentation.

Your parts operation balances conflicting pressures: maintain high fill rates for critical components, minimize carrying costs on slow-moving inventory, and manage substitutes as original parts reach end-of-life. Generic forecasting treats a 5-year-old robot the same as a 25-year-old one, missing the degradation curves that drive real demand.

API-first platforms deploy in 8-12 weeks with immediate value from pre-built forecasting models. Custom builds require 18-24 months for ML model development, data pipeline construction, and integration work—plus ongoing maintenance costs that exceed initial development within 3 years.

Critical connections include your ERP for order history and stock levels, CMMS for maintenance schedules and failure data, field service system for parts consumption patterns, and telemetry feeds for equipment condition monitoring. These data sources train more accurate demand models than order history alone.

The platform provides base forecasting trained on industrial failure patterns, then exposes APIs for your team to layer custom logic—safety stock rules for critical machinery, substitute hierarchies for obsolete parts, or regional warehouse allocation based on installed base density. You extend rather than replace core capabilities.

Look for platforms with documented REST APIs for all core functions, support for standard data formats, and no proprietary data storage requirements. Your data stays in your systems while the platform reads and writes through open interfaces. If you switch vendors later, integrations disconnect cleanly without data migration.

Track fill rate changes for high-priority equipment lines, compare forecast accuracy to historical methods, measure carrying cost shifts from better stock allocation, and monitor emergency shipment frequency. Most industrial OEMs see 15-20% forecast accuracy improvement and 10-15% carrying cost reduction within the first quarter.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how Bruviti combines pre-built forecasting with open APIs for industrial parts inventory.

Schedule Demo