With technician expertise walking out the door and truck rolls costing $800+ per dispatch, timing your field service AI approach is critical.

For industrial OEMs, buying field service AI delivers faster ROI than building. Pre-trained models understand machine failures, integrate with FSM systems, and reduce technician truck rolls within weeks—not years.

Building field service AI from scratch requires hiring specialized talent, assembling training data from decades of service records, and iterating on model accuracy. Most industrial OEMs need 18-24 months before seeing production results.

Field service AI demands domain expertise in industrial equipment diagnostics, plus machine learning capabilities, plus FSM integration knowledge. Few teams possess all three, and hiring takes 6-12 months per specialist.

While you build, competitors deploy. Every quarter without AI-assisted dispatch means higher service costs, lower first-time fix rates, and technician frustration—competitive disadvantages that compound over time.

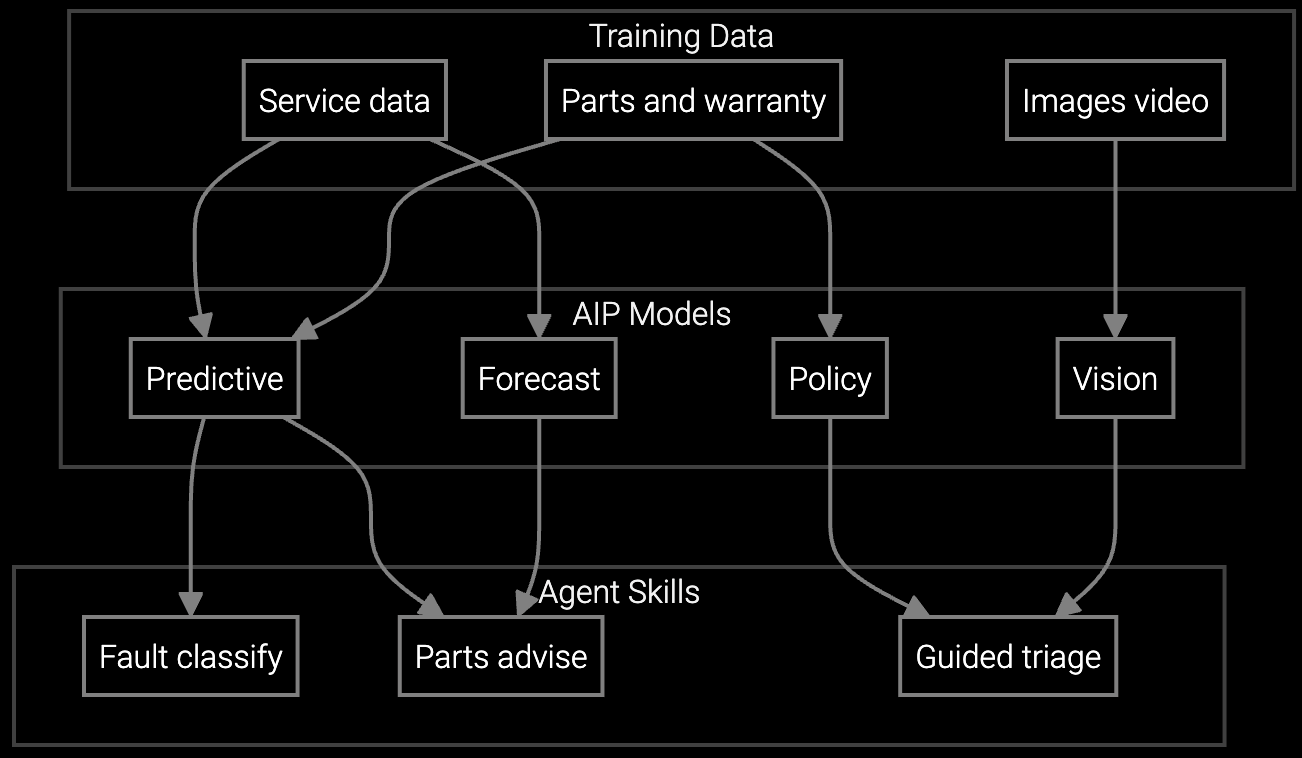

The strategic answer for most industrial OEMs is neither pure build nor pure buy—it's a hybrid approach that delivers immediate value while preserving long-term flexibility. Bruviti provides pre-trained models that already understand industrial equipment failure patterns, integrate with existing FSM platforms like ServiceMax or SAP, and reduce technician truck rolls within weeks of deployment.

This approach solves the timing problem: you get production results in 4-6 weeks instead of 18-24 months. But unlike traditional vendor lock-in, API-first architecture means you can customize, extend, or eventually replace components as your internal capabilities mature. Start with fast wins—parts prediction, dispatch optimization, automated job documentation—then build custom models only where you need true differentiation.

Pre-stage the right parts before dispatch for CNC machines, pumps, and industrial robots—improving first-time fix rates by 18-25% and eliminating wasted truck rolls.

Correlate vibration data, temperature trends, and historical failure patterns to identify root causes faster—preserving retiring technician expertise in the model.

Mobile copilot delivers repair procedures, diagnostic recommendations, and parts alternatives on-site—reducing mean time to repair by 20-30%.

Industrial equipment operates on 10-30 year lifecycles, meaning your service organization supports CNC machines, turbines, and automation systems with decades of undocumented tribal knowledge. Building AI from scratch means digitizing 20+ years of failure patterns, repair procedures, and technician expertise before training the first model—a data archaeology project that takes years.

Pre-trained models already understand industrial equipment failure signatures across pumps, compressors, machine tools, and power generation assets. They integrate with SCADA data, PLC telemetry, and condition-based monitoring systems your equipment already generates. This means you skip the multi-year data preparation phase and start with models that recognize vibration anomalies, bearing wear patterns, and thermal drift on day one.

Pre-built platforms like Bruviti deploy in 4-6 weeks with immediate truck roll reduction. Building in-house requires 18-24 months for data preparation, model training, FSM integration, and technician adoption. Most industrial OEMs see ROI from a buy approach within the first quarter, while build approaches require 2+ years before breaking even.

Pre-trained models learn general failure patterns across industrial equipment—vibration signatures, thermal drift, bearing wear—that apply even to custom machinery. For truly unique assets, API-first platforms let you extend with custom models trained on your proprietary data while leveraging the pre-built foundation for common diagnostics. This hybrid approach delivers 80% of value immediately while you build the remaining 20%.

API-first architecture is the critical factor. Platforms with open APIs for data ingestion, model inference, and workflow integration let you swap components without replacing the entire stack. Verify that your FSM integrations use standard REST APIs, your models can be exported or replaced, and your data remains in your control. This preserves optionality while delivering speed.

You'll need integration expertise to connect FSM systems and telemetry feeds, change management skills to drive technician adoption, and business analysts to measure ROI and refine workflows. You don't need machine learning specialists or data scientists initially—those become valuable as you mature and want to build custom models for differentiation.

Build when field service AI is a core competitive differentiator—not just a cost reduction tool—and you have the 18-24 month runway to develop proprietary capabilities. For most industrial OEMs, service is important but not the primary differentiator, making buy-then-extend the faster path. Start with a platform, prove ROI, then build custom models only where you need unique competitive advantage.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

See how Bruviti's pre-trained models reduce truck rolls and improve first-time fix rates without the 18-month build timeline.

Schedule Demo