When lithography downtime costs $1M+ per hour, stockouts kill margins—but so does holding $50M in stale inventory.

AI-driven demand forecasting predicts chamber component failures and consumable needs 4-6 weeks ahead, enabling just-in-time parts positioning that cuts carrying costs 30-40% while maintaining 98%+ fill rates for critical semiconductor tooling.

Unpredictable chamber kit failures force same-day air shipments from regional warehouses. Next-flight-out logistics for a single FOUP carrier can exceed $8,000—costs that accumulate faster than finance can track them.

Process node transitions render entire shelves of metrology consumables obsolete overnight. EUV versus DUV recipe changes mean stocked chamber parts never get installed—capital tied up in assets that will never generate revenue.

Singapore has three spares for a critical pump module while Austin waits four days for the same part. No visibility across regional warehouses means duplicate safety stock at every location—multiplying carrying costs without improving availability.

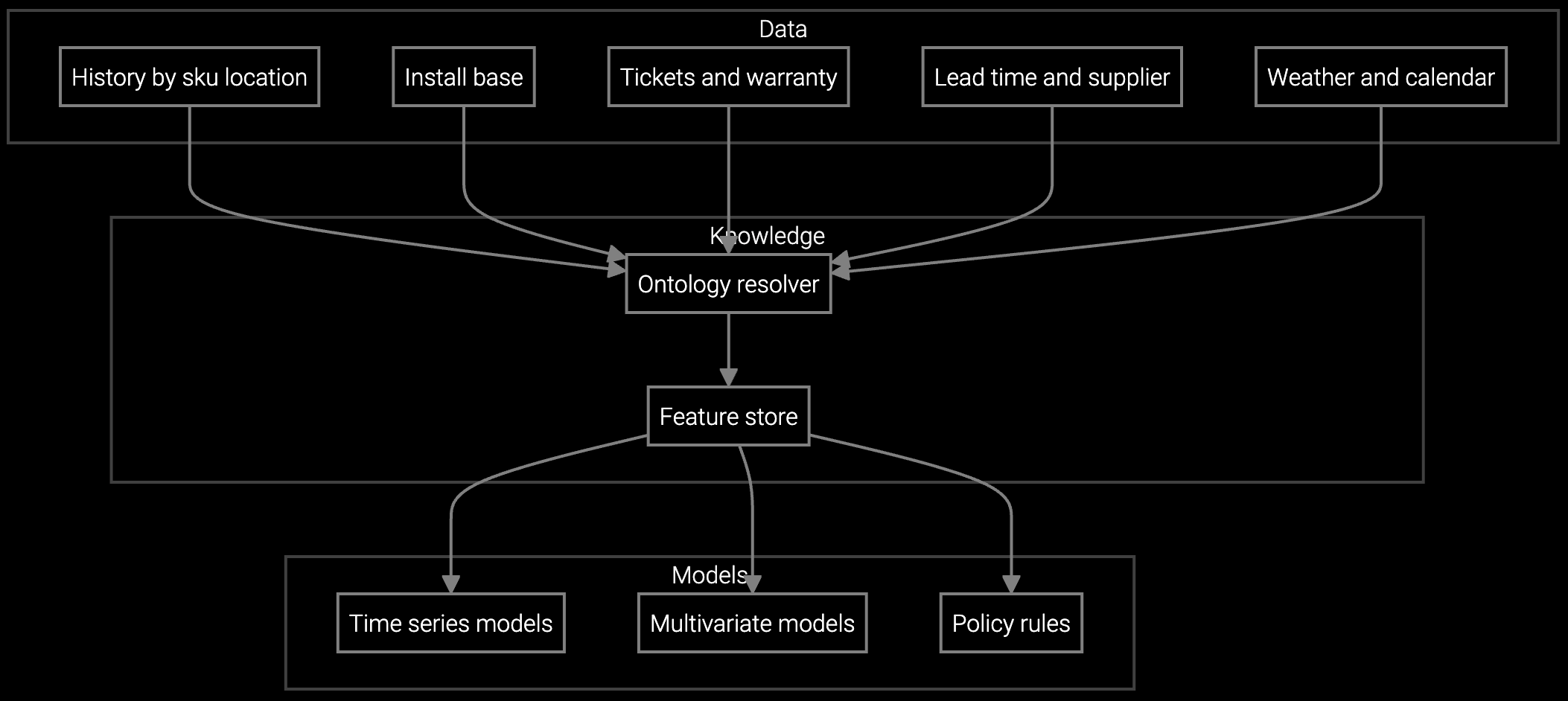

Bruviti's platform ingests process telemetry, PM schedules, and historical failure patterns to forecast parts demand by tool type and location. The AI identifies which chamber components degrade fastest under specific recipe conditions—predicting replacement windows before OEE drops.

The system correlates wafer throughput trends with consumable depletion rates, automatically adjusting reorder points as fab utilization shifts. When a litho tool shows early signs of alignment drift, the platform flags upcoming metrology calibration kit needs and routes inventory from the nearest warehouse with excess stock. This closes the loop between predictive maintenance signals and just-in-time parts positioning.

Forecasts chamber kit and consumable needs by fab, tool type, and process recipe—enabling semiconductor OEMs to optimize regional warehouse stock levels.

Predicts optimal reorder timing and quantities for high-value semiconductor components, balancing carrying costs against stockout risk.

Enables fab technicians to snap photos of chamber components and instantly identify part numbers, availability, and substitute options.

Semiconductor tooling generates process telemetry at millisecond intervals—chamber pressure, gas flow rates, RF power levels, wafer temperature. This data stream reveals component wear patterns invisible to scheduled PM calendars. A plasma etch tool running aggressive recipes consumes electrode materials faster than baseline assumptions predict.

The platform correlates recipe changes with parts consumption velocity. When a fab transitions from 7nm to 5nm nodes, the AI recalibrates demand forecasts for metrology consumables and chamber kits specific to the new process window. This prevents both stockouts during ramp and obsolete inventory from prior-generation recipes.

The platform uses transfer learning from similar tool types and recipes, then refines predictions as the new node generates its own telemetry. Early forecasts rely on equipment vendor baseline data and comparable process windows from adjacent nodes. Prediction accuracy improves 15-20% per quarter as fab-specific patterns emerge.

Most semiconductor OEMs see ROI within 6-9 months. Emergency freight savings materialize immediately—often covering software costs in the first quarter. Inventory carrying cost reductions compound over 12-18 months as safety stock levels drop and obsolescence write-offs decline.

The AI assigns confidence scores to every prediction and maintains dynamic safety stock buffers for low-confidence forecasts. When actual consumption deviates from predictions by more than 15%, the system triggers alerts and temporarily increases reorder quantities until pattern stability returns. This adaptive approach balances cost reduction with availability risk.

Yes. The system models regulatory constraints as routing rules—identifying which parts can cross borders freely and which require local stocking. It optimizes within those constraints, recommending regional warehouse positioning that minimizes total carrying cost while respecting trade compliance requirements.

The platform maintains cross-reference tables linking OEM part numbers to functionally equivalent alternatives, validated against equipment specs and recipe compatibility. When primary inventory is depleted, the AI surfaces approved substitutes with compatibility confidence scores—enabling service continuity without risking process qualification violations.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how AI-driven forecasting optimizes semiconductor parts positioning across your multi-fab network.

Schedule Executive Briefing