With warranty costs climbing and NFF rates eroding margins, network OEMs need a strategic decision framework now.

Network OEMs face a strategic choice: build internal warranty AI or adopt proven platforms. Platform approaches deliver faster ROI, lower NFF rates, and fraud detection without multi-year development cycles or dedicated ML teams.

Building warranty AI internally requires 18-24 months before production deployment. During that window, warranty costs continue rising while competitors deploy faster solutions.

Building in-house requires hiring specialized ML engineers, maintaining training infrastructure, and competing for talent against tech giants. Most network OEMs lack this core competency.

Every quarter spent building internal solutions means another quarter of unchecked fraudulent claims, high NFF rates, and manual processing. The warranty reserve erosion compounds while development continues.

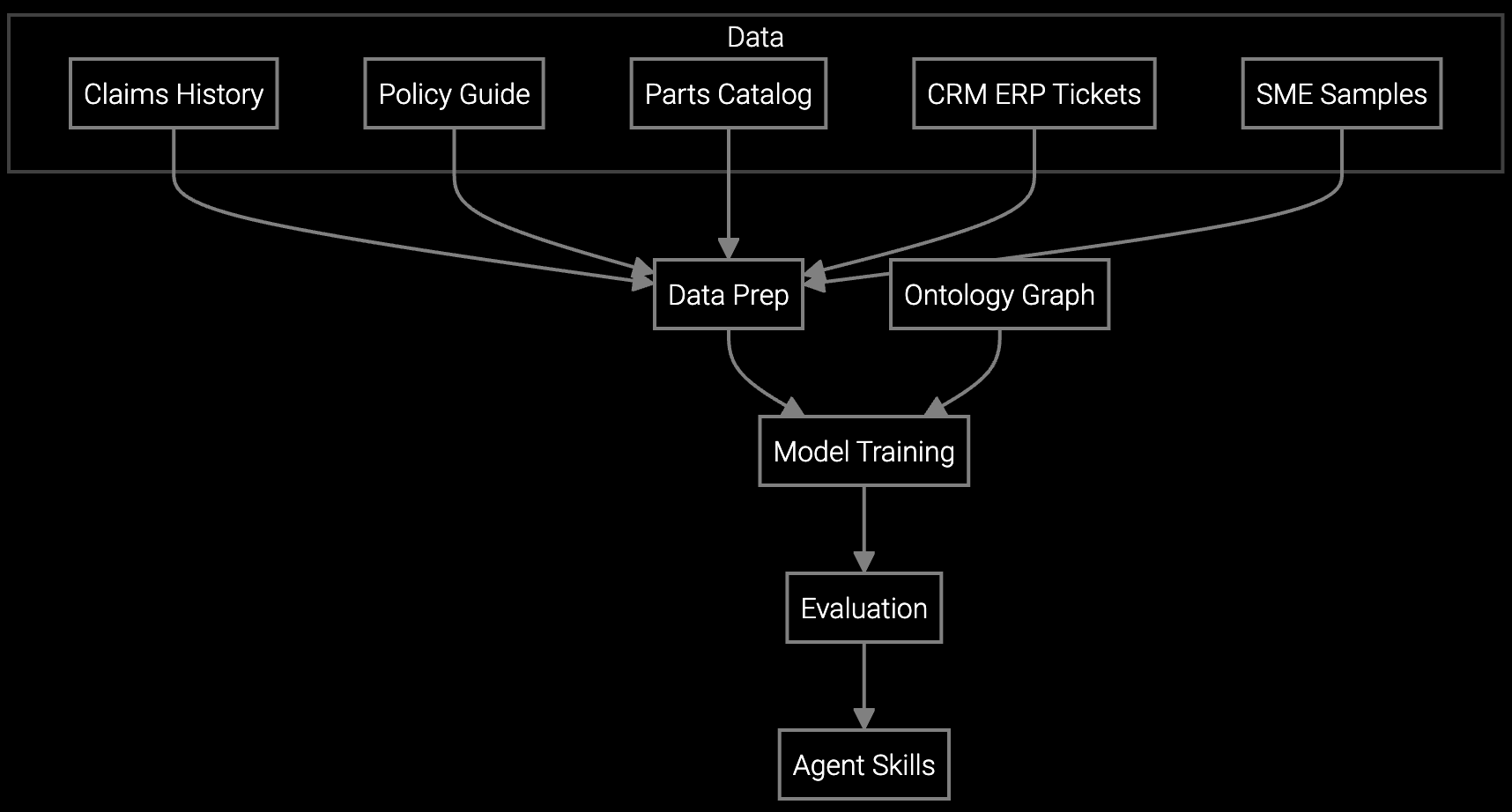

The build vs. buy decision hinges on three factors: time to value, core competency alignment, and total cost of ownership. For network OEMs, warranty AI is not a differentiator—it's operational infrastructure. The platform approach delivers pre-trained models for entitlement verification, NFF prediction, and fraud detection on day one. Integration happens through standard APIs connecting to existing RMA and ERP systems. Your team focuses on configuring business rules for router RMA policies, firewall warranty tiers, and escalation thresholds—not building ML pipelines.

Hybrid deployment gives you control without the multi-year commitment. Start with pre-built fraud detection and entitlement validation to prove ROI in 90 days. Expand to NFF prediction for high-volume SKUs once you see results. The platform handles model retraining as your product mix evolves from legacy routers to 5G infrastructure. No lock-in—your data stays yours, and APIs allow migration if business needs change.

Automatically classify router and switch RMAs by failure type, reducing manual review time and improving warranty reserve accuracy for network equipment portfolios.

Analyze microscopic images of returned network components to validate warranty claims and identify manufacturing defects versus customer mishandling.

Network equipment manufacturers face unique warranty complexity: firmware vulnerabilities trigger mass RMAs, configuration errors mimic hardware failures, and 24/7 uptime requirements demand instant claims processing. Building AI to handle this requires training data from millions of router, switch, and firewall returns—data no single OEM possesses at scale.

Platform providers bring cross-industry training sets that recognize patterns like power supply failures in PoE switches, optical transceiver degradation, and firmware-induced crashes. Your warranty team gets proven models on day one, not experimental prototypes after two years of development. The strategic advantage comes from deploying faster than competitors, reducing warranty reserves sooner, and freeing engineering talent to focus on next-generation network products.

Platform deployment typically takes 8-12 weeks from kickoff to production, including API integration and business rule configuration. Building internally requires 18-24 months for MVP, plus ongoing maintenance and retraining cycles. The platform approach delivers ROI in the first quarter rather than waiting two years for initial results.

Modern platforms use your data to improve your models without sharing it across customers. You retain full data ownership and can export all records at any time. API-first architectures mean no lock-in—your warranty systems remain independent, and you can switch providers if business needs change.

Yes. Platforms provide configurable business rules for warranty tier management, entitlement verification by product line, and custom RMA workflows. You define policies for router extended warranties, firewall replacement tiers, and optical transceiver failure thresholds. The platform enforces your rules while handling the AI-powered fraud detection and NFF prediction.

Network OEMs typically see 30-40% NFF rate reduction within six months, 20-25% faster claims processing, and fraud detection rates above 85%. For a $500M revenue OEM spending 2-3% on warranty costs, this translates to $2-4M annual savings. Payback period is usually under one year compared to multi-year investments for internal builds.

Choose platforms with open API architectures, standard data formats, and no proprietary model formats. Ensure contracts include data export rights and model portability clauses. Many OEMs start with one use case like fraud detection, validate results, then expand—avoiding big-bang commitments. The platform should integrate with your systems, not replace them.

Software stocks lost nearly $1 trillion in value despite strong quarters. AI represents a paradigm shift, not an incremental software improvement.

Function-scoped AI improves local efficiency but workflow-native AI changes cost-to-serve. The P&L impact lives in the workflow itself.

Five key shifts from deploying nearly 100 enterprise AI workflow solutions and the GTM changes required to win in 2026.

See how Bruviti's platform delivers warranty ROI in weeks, not years, without building internal ML teams.

Schedule Strategic Demo