Legacy equipment lifecycles and obsolescence risk demand strategic inventory decisions now.

Industrial OEMs balance demand forecasting precision against inventory carrying costs. AI-driven platforms deliver pre-built forecasting models with custom integration flexibility, reducing time-to-value while maintaining control over parts data and workflows.

Custom forecasting systems require 18-24 month development cycles with data science teams. Model accuracy lags market benchmarks during initial years, exposing margins to stockout and excess inventory costs.

Traditional inventory software locks parts data and business logic into proprietary systems. Migration costs escalate as customization accumulates, reducing strategic flexibility for future technology shifts.

Competitors deploying AI forecasting gain 15-20% inventory cost advantage. Internal build timelines extend market gap, pressuring margins as obsolescence and emergency shipping costs compound.

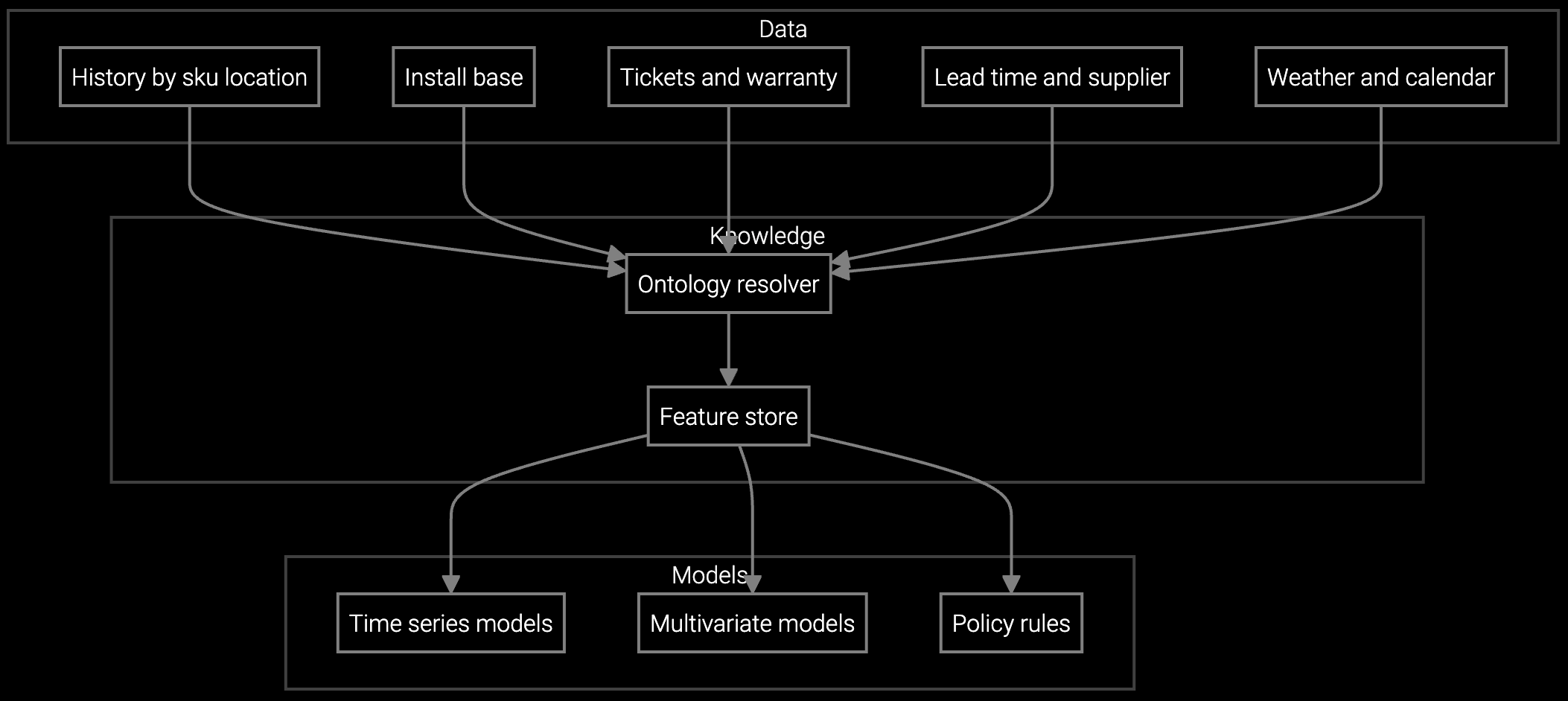

Bruviti's platform addresses the build-versus-buy dilemma by combining deployment speed with technical control. Pre-trained demand forecasting models ingest existing ERP and warranty data, delivering actionable predictions within weeks rather than quarters. This eliminates the data science hiring burden while maintaining integration flexibility through open APIs.

The architecture separates forecasting intelligence from data custody. Parts inventory remains in your systems while the platform provides prediction layers. This design supports phased rollout—pilot with high-value SKUs, measure fill rate improvement, then scale across product lines without rearchitecting core systems.

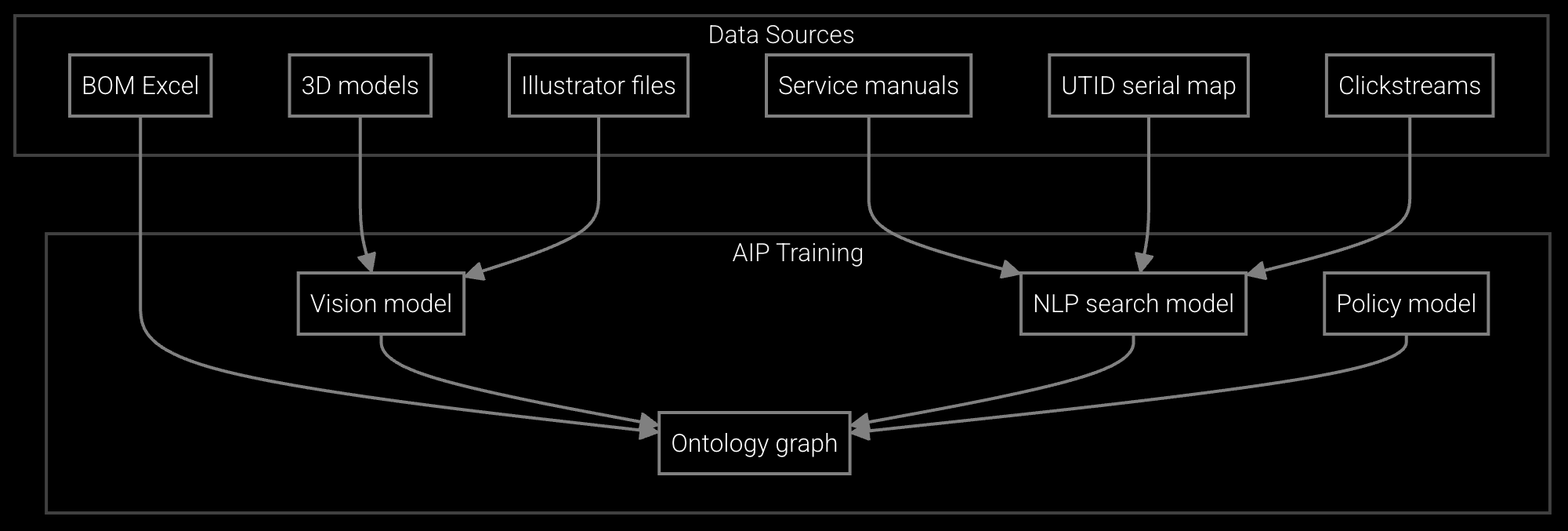

Forecasts parts demand for CNC machines and turbines by region and time window, optimizing stock levels across distributed warehouses serving industrial customers.

Projects consumption for legacy heavy equipment based on installed base age, run hours, and seasonal production cycles in manufacturing facilities.

Automatically maintains parts catalogs for equipment spanning 10-30 year lifecycles, mapping engineering changes and substitute parts for obsolescence management.

Industrial OEMs managing 10-30 year equipment lifecycles face unique inventory challenges. Legacy pumps, compressors, and CNC machines accumulate parts obsolescence faster than forecasting models can adapt. Custom-built systems struggle to incorporate tribal knowledge from retiring service engineers who understand substitution patterns across equipment generations.

Platform-based forecasting accelerates value by ingesting decades of service history without requiring clean data migration. Models learn from incomplete maintenance records and warranty claims, identifying demand patterns human analysts miss. This matters for industrial portfolios where a single high-value machine downtime event costs more than years of inventory optimization savings.

Platform deployment typically completes in 90 days from data connection to production forecasts, versus 18-24 months for custom builds. The platform uses pre-trained models that adapt to your equipment data, eliminating the machine learning development phase that dominates build timelines.

Parts inventory remains in your ERP system. The platform accesses historical demand and equipment data via API for prediction generation, then returns forecasts to your systems. You control data retention policies and can disconnect at any time without losing access to your inventory records.

Platform models typically achieve 85-90% forecast accuracy within the first quarter, matching or exceeding custom-built systems that require 2-3 years of tuning. Pre-training on cross-industry equipment failure patterns accelerates learning from your specific data.

API-first architecture supports standard REST and GraphQL integration patterns. If you migrate ERP systems or add warehouse management software, forecast delivery adapts through configuration changes rather than custom development. This reduces future switching costs compared to monolithic inventory platforms.

Track fill rate improvement and carrying cost reduction for pilot SKUs monthly. Industrial OEMs typically measure success through reduced emergency shipping costs and stockout frequency for high-value parts. Board reporting focuses on inventory turn improvement and margin protection from obsolescence avoidance.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

Explore how Bruviti's platform accelerates deployment without sacrificing control.

Schedule Strategy Discussion