Manual inventory processes cost semiconductor OEMs millions in carrying costs while missing the $1M-per-hour fab downtime window.

AI orchestrates end-to-end parts inventory workflows for semiconductor OEMs—automating demand forecasting, substitute matching, and replenishment decisions to reduce carrying costs while maintaining fab uptime.

Chamber kits and high-value spares sit in warehouses because manual forecasting over-provisions to avoid stockouts. Safety stock policies from static spreadsheets lock millions in idle inventory.

When a lithography tool or etcher goes down, missing parts trigger emergency shipments and extended downtime. Manual substitute matching can't keep pace with fab urgency.

Sub-5nm process equipment evolves rapidly. Manual tracking of EOL notifications and alternative parts leaves OEMs holding obsolete inventory or scrambling for last-time-buy decisions.

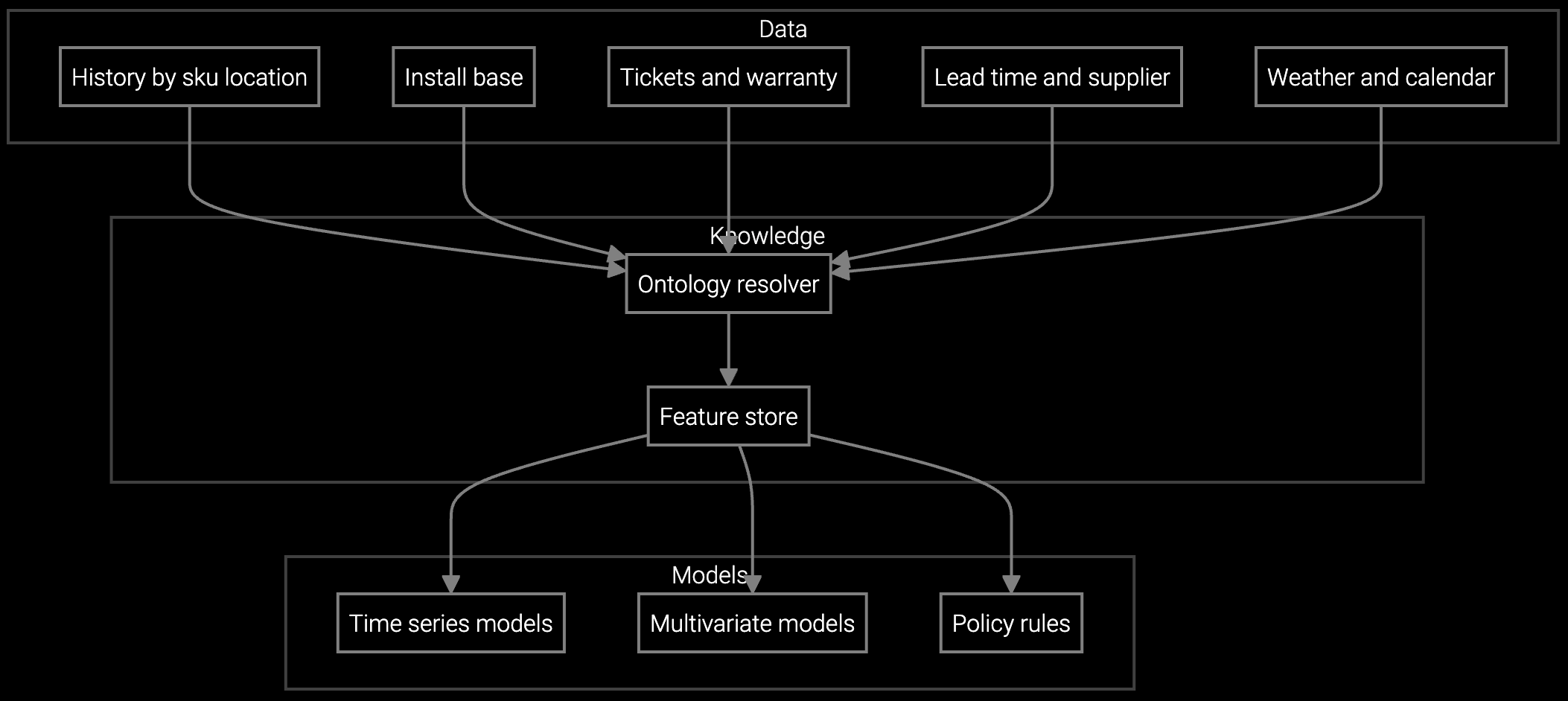

The platform executes the entire inventory workflow autonomously—from demand signal detection through replenishment decision. Instead of inventory planners reacting to shortages or manually building forecasts, the AI continuously ingests equipment telemetry, service history, and installed base age to predict parts consumption by location and time window. It identifies substitute parts when primary stock is unavailable and auto-generates replenishment orders within approved thresholds.

For executives managing margins, this eliminates the trade-off between inventory carrying costs and fab uptime risk. The AI optimizes safety stock levels dynamically based on lead times and criticality, freeing capital while maintaining availability. Workflow automation cuts planning headcount and reduces emergency shipment costs—quantifiable margin improvements without sacrificing service levels.

Forecasts chamber kit and consumable demand by fab location, optimizing stock levels for lithography and etch tools while reducing capital tied up in safety inventory.

Projects parts consumption based on installed base age, wafer throughput, and preventive maintenance schedules—catching demand spikes before stockouts occur.

AI reads technical drawings for etch chambers and deposition tools to identify part numbers instantly, accelerating service quoting and substitute parts matching.

Semiconductor equipment OEMs face inventory complexity unlike any other industry. A single lithography system contains thousands of consumable parts—chamber kits, optics, pumps, valves—each with different failure curves and lead times. Fabs run 24/7 with $1M+ per hour downtime costs, making stockouts catastrophic. Yet over-provisioning ties up capital at scale: a typical 300mm fab carries $50M+ in spare parts inventory.

Manual forecasting can't process the signal volume. Equipment telemetry, PM schedules, recipe changes, and throughput fluctuations all affect parts consumption, but planners rely on historical averages and safety stock rules. The result: excess inventory in low-risk areas, stockouts in high-criticality parts, and emergency freight costs eroding margins.

The platform ingests equipment telemetry, preventive maintenance schedules, and installed base age to predict parts consumption by tool and location. This replaces static safety stock rules with dynamic inventory levels—reducing over-provisioning in low-risk areas while maintaining availability for critical tools. OEMs typically see 25-35% reductions in carrying costs within the first year.

Executives see margin impact within 90 days. Early ROI comes from eliminating emergency freight costs and reducing expedited shipments. Longer-term gains come from inventory optimization—lower carrying costs and higher turns—plus reduced planning headcount. Typical semiconductor OEMs achieve payback in 8-12 months based on freight savings and inventory reductions alone.

The AI monitors EOL notifications and supplier communications to flag obsolescence risk months before manual processes would catch it. When a critical part is going obsolete, the platform identifies substitute parts based on technical specifications and installed base compatibility, then recommends last-time-buy quantities or re-engineering needs. This prevents both obsolete inventory write-offs and emergency redesigns.

Yes. The platform connects to SAP, Oracle, and Salesforce via APIs to pull service history, installed base data, and order records. Replenishment recommendations flow back into ERP procurement workflows for approval and execution. For semiconductor OEMs, integration typically includes equipment telemetry feeds and PM scheduling systems to improve forecast accuracy.

Track three margin-critical KPIs: inventory carrying cost as a percentage of revenue, fill rate (parts availability when needed), and emergency freight spend. Executives should expect 28-35% reductions in carrying costs, 95%+ fill rates, and 40-50% cuts in expedited shipment costs. Also monitor inventory turns—higher turns mean less capital locked in idle stock—and forecast accuracy to demonstrate planning improvement.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

See how semiconductor OEMs are reducing carrying costs while maintaining fab uptime.

Schedule Executive Briefing