Chamber component stockouts cost fabs millions per hour—getting forecasting right is now a competitive imperative.

Deploy AI-driven demand forecasting by integrating telemetry feeds from fab tools, ERP inventory data, and service case histories. Start with high-value chamber components where stockouts cost millions per hour. Measure success through fill rate improvement and carrying cost reduction.

Semiconductor OEMs maintain $50M+ in parts inventory per fab to avoid catastrophic stockouts. Traditional min-max reorder logic ignores usage patterns, process changes, and tool age—resulting in chronic overstock of low-velocity items and emergency airfreight for critical chamber components.

A missing showerhead or focus ring can halt production for 12-48 hours while parts ship from regional depots. With EUV tools costing $1M+ per hour in lost wafer throughput, even rare stockouts erode quarterly margin and trigger penalty clauses in OEM service agreements.

Recipe changes and new process nodes alter chamber consumable lifetimes unpredictably. Service teams lack visibility into how process engineer tuning impacts parts consumption—leading to forecast errors that compound as the installed base ages and diversifies across technology generations.

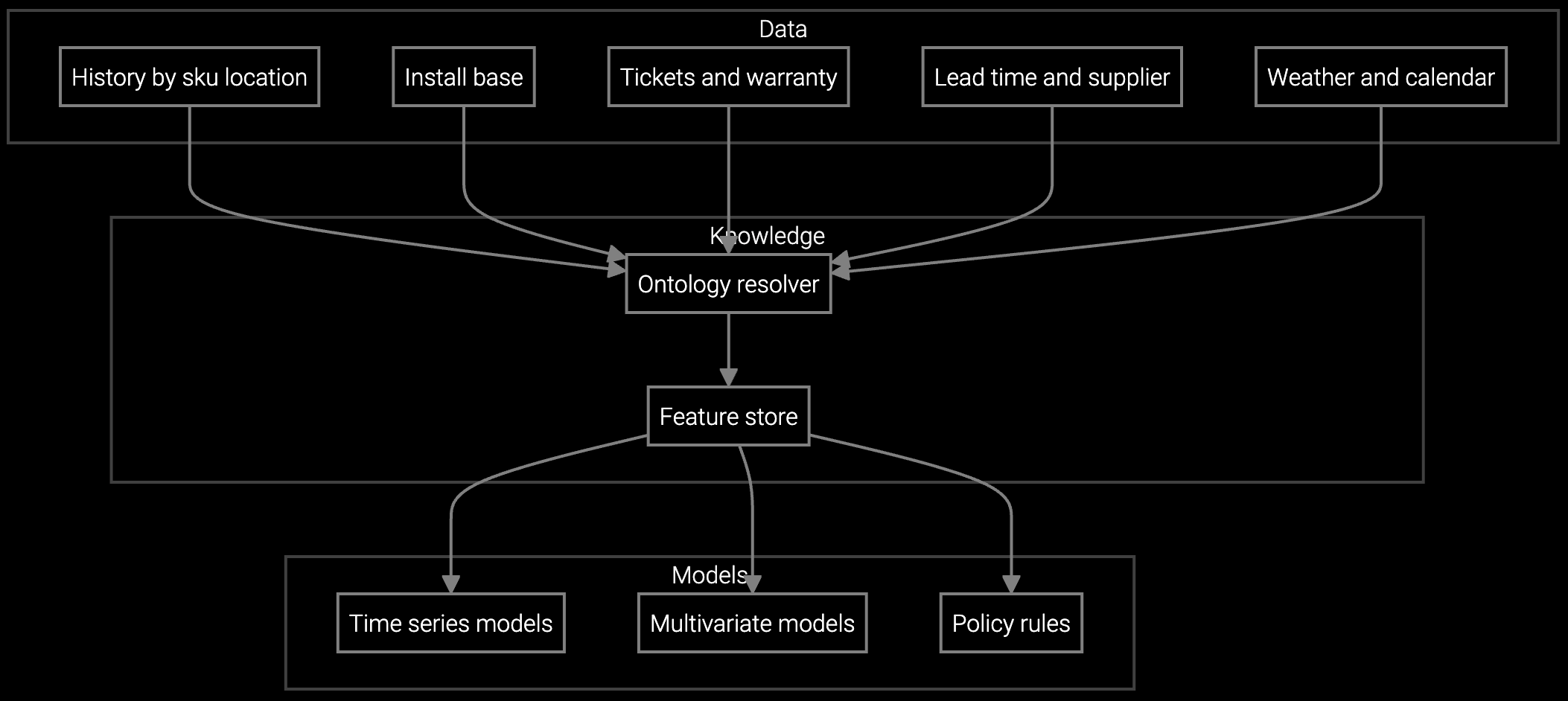

Bruviti's platform ingests telemetry from etch, deposition, and lithography tools—correlating process parameters, runtime hours, and chamber PM cycles with historical parts consumption. The AI identifies which tool behaviors predict specific component failures, then generates location-specific demand forecasts by SKU and time window. This eliminates the guesswork from reorder triggers and safety stock calculations.

The implementation starts by connecting existing ERP inventory systems and service case databases to the platform's API. Once telemetry feeds are live, the AI trains on 12-24 months of historical data to establish baseline consumption patterns. Service leadership sees projected ROI within 90 days as emergency shipments decline and excess stock begins to clear from low-velocity bins.

Projects chamber component consumption based on tool telemetry, installed base age, and process recipe changes—reducing forecast error by 50%+ for high-value semiconductor parts.

Forecasts demand by fab location and time window, optimizing safety stock levels to balance carrying costs against the million-dollar-per-hour cost of stockouts in advanced semiconductor manufacturing.

AI reads technical drawings and chamber assembly schematics to identify part numbers and suggest substitutes—accelerating quoting for custom tool configurations and legacy equipment support.

Semiconductor OEMs face unique inventory complexity: hundreds of SKUs per tool platform, consumable lifetimes measured in wafer starts rather than calendar time, and process recipe variations that make historical averages unreliable. A showerhead that lasts 60,000 wafers on one process might fail at 35,000 on another—rendering traditional time-based forecasting useless.

The platform correlates RF power, gas flow rates, and chamber pressure data with actual component replacements across your installed base. This reveals which process signatures predict imminent failure, enabling demand forecasts that account for both tool age and current operating conditions. The result: safety stock levels that shrink as forecast accuracy improves, freeing capital without gambling on uptime.

Effective forecasting requires three inputs: equipment telemetry from fab tools (process parameters, runtime hours, PM cycles), ERP inventory data (current stock levels, consumption history, lead times), and service case records (part replacement history, failure modes). The AI correlates these to predict demand by SKU and location. Most semiconductor OEMs can integrate these feeds in 30-60 days using standard APIs.

Track three metrics quarterly: total inventory carrying cost as a percentage of annual parts spend (target 15-20% reduction), fill rate for critical chamber components (target 92%+ without increasing safety stock), and emergency shipment frequency (target 60%+ reduction). CFOs typically see positive ROI within six months as excess stock clears and expedited freight costs drop, with full payback in 12-18 months for mid-size semiconductor OEMs.

Start with etch or CVD deposition tools where chamber consumables (showerheads, focus rings, liners) represent 40-60% of parts spend and have predictable wear patterns tied to process parameters. These tools generate rich telemetry and have well-documented replacement cycles, making them ideal for training the AI. Expand to lithography and metrology tools once the initial deployment proves forecast accuracy and inventory reduction targets.

The AI continuously retrains as new process data arrives, detecting shifts in consumption patterns within 2-3 weeks of a recipe change. When a new process node launches, the platform flags increased forecast uncertainty and recommends temporary safety stock buffers until 30+ days of operating data are available. This adaptive approach prevents stockouts during ramps while avoiding the permanent inventory bloat that results from static safety stock rules.

Bruviti provides REST APIs and pre-built connectors for SAP, Oracle, and ServiceNow. Most semiconductor OEMs complete integration in 4-8 weeks: two weeks for API configuration and data mapping, two weeks for historical data backfill, and 2-4 weeks for user acceptance testing and training. No custom code is required—IT teams configure data flows using a visual mapping interface that connects to existing ERP and CRM systems without modifying core business logic.

SPM systems optimize supply response but miss demand signals outside their inputs. An AI operating layer makes the full picture visible and actionable.

Advanced techniques for accurate parts forecasting.

AI-driven spare parts optimization for field service.

Connect your telemetry and inventory data in a 30-day pilot—measure fill rate and carrying cost impact before committing to full deployment.

Schedule Discovery Call