Legacy equipment, retiring expertise, and integration complexity make this decision uniquely high-stakes for manufacturers.

Field service AI for industrial equipment can be built in-house for full control, purchased for speed, or implemented via API-first platforms that offer pre-trained models with customization. Choice depends on technical capacity, timeline, and integration needs.

Industrial equipment generates telemetry from PLCs, SCADA systems, and legacy sensors. Field service platforms must connect to SAP, Oracle FSM, and custom data lakes built over decades.

Senior technicians with 20+ years of equipment expertise are retiring faster than knowledge can be documented. Building models from scratch requires data science teams to learn domain expertise they don't have.

Building field service AI requires recruiting ML engineers, collecting training data, building infrastructure, and iterating on models. Purchase decisions involve vendor evaluation, POC cycles, and change management.

The build-versus-buy framing creates a false binary. Pure build gives control but demands specialized ML talent and years of model training. Pure buy delivers speed but often locks you into closed ecosystems where you can't retrain models on proprietary failure data or extend functionality when business needs change.

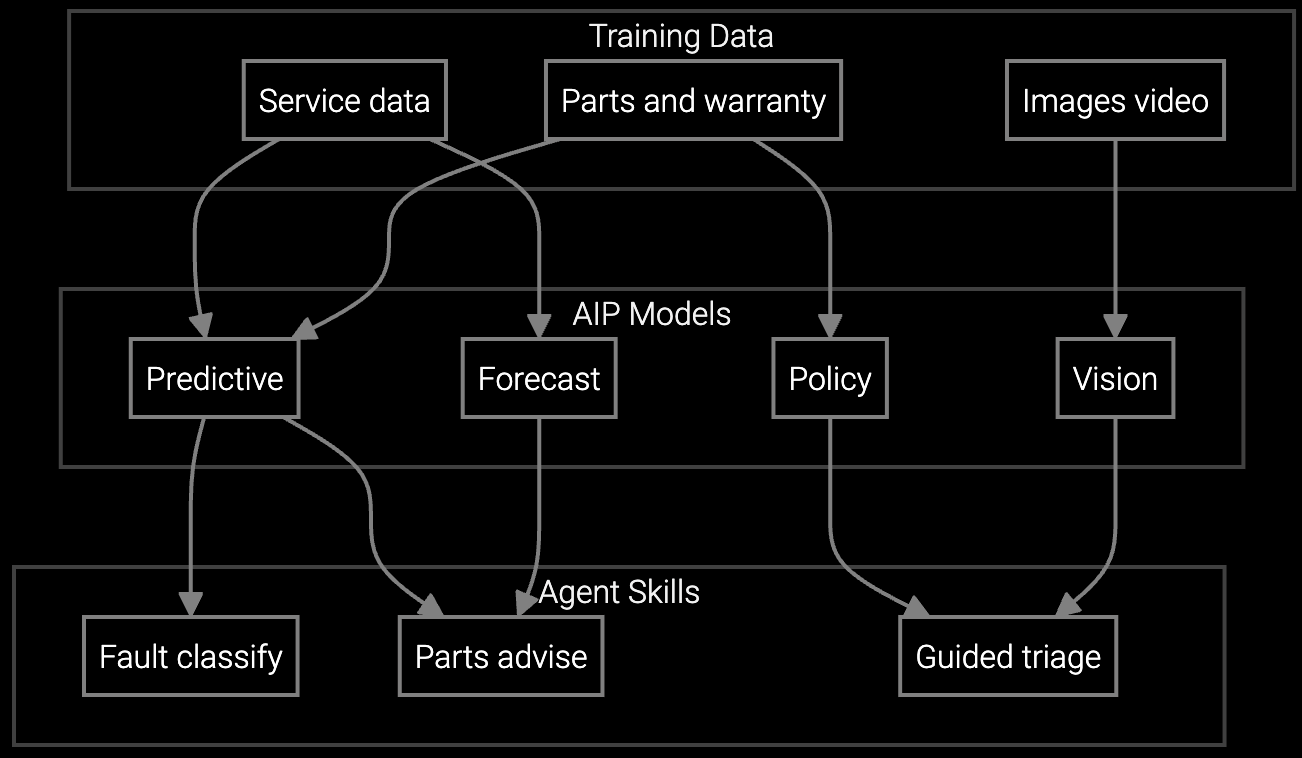

An API-first platform with pre-trained industrial models offers a third path. You get foundation models already trained on equipment telemetry patterns, parts failure modes, and technician decision trees. Python and TypeScript SDKs let you customize without vendor dependency. Your engineering team retains control over data pipelines, model retraining schedules, and integration architecture while avoiding the heavy lifting of training foundation models from scratch.

Predicts which parts technicians need for CNC machines, compressors, and turbines before dispatch, reducing repeat visits to remote industrial sites.

Captures tribal knowledge from retiring technicians into AI models that correlate vibration patterns, temperature anomalies, and historical failure modes.

Mobile SDK delivers real-time diagnostic guidance, repair procedures, and equipment history to technicians on factory floors and remote sites.

Industrial equipment OEMs face unique constraints that generic service AI can't address. Your installed base includes machines deployed 10-30 years ago with incomplete documentation. Telemetry comes from PLCs and SCADA systems using proprietary protocols. Service contracts obligate 24/7 uptime for power generation turbines, automotive assembly robots, and semiconductor fabrication tools where downtime costs millions per hour.

Standard AI platforms treat all service calls equally. Industrial reality demands models that understand vibration signatures from specific bearing types, recognize thermal drift patterns in decades-old controllers, and correlate failure modes across equipment generations. Your build-versus-buy decision hinges on whether the platform already speaks your equipment's language or forces you to translate everything yourself.

Choose platforms with open API architectures, support for standard data formats like JSON and Parquet, and SDKs in Python or TypeScript. Avoid systems that store models in proprietary formats you can't export or that require their infrastructure to run inference. Your data pipelines, model weights, and integration code should remain portable.

Building requires ML engineers experienced with time-series models, NLP for unstructured technician notes, and computer vision for equipment images. You need data engineers to build pipelines from PLCs and SCADA systems, DevOps teams for model deployment infrastructure, and domain experts to validate model outputs. Most industrial OEMs estimate 8-12 full-time staff for 18-24 months before production deployment.

This depends entirely on the platform architecture. Closed systems offer no retraining. API-first platforms with SDK access allow you to fine-tune models on your failure data, add custom features from telemetry streams, and adjust prediction logic for equipment-specific failure modes. Verify model ownership and retraining rights before purchase.

Integration requires bidirectional data flows: work orders, technician schedules, and parts inventory from FSM systems; predictions, recommended actions, and diagnostic insights back to dispatchers. REST APIs work for real-time queries. Batch ETL handles historical data for model training. Middleware like MuleSoft or custom integration layers often sit between AI platforms and legacy ERP systems. Plan for 2-3 months of integration work regardless of build or buy approach.

Migration risk depends on data portability and model ownership. If you own model weights, training data, and integration code, migrating to self-hosted infrastructure takes weeks. If the vendor owns models and uses proprietary data formats, migration requires rebuilding from scratch. Define exit strategy and data ownership terms in initial contracts to preserve optionality.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

Review API documentation, SDK samples, and integration patterns before making your build-versus-buy decision.

Talk to an Engineer