Five-nines uptime demands and rising truck roll costs force service leaders to act now or lose margin.

Deploy AI field service in phases: start with parts prediction for high-volume repairs, integrate with existing FSM systems via API, measure first-time fix improvement within 90 days to prove ROI before scaling.

Leadership demands proof before committing budget. Without a phased deployment showing measurable first-time fix gains within 90 days, AI projects die in pilot phase while truck roll costs climb.

Service leaders worry AI will disrupt existing FSM workflows. Network equipment OEMs need API-first architecture that preserves dispatch logic while adding predictive parts intelligence.

Senior technicians resist AI recommendations if deployment ignores their expertise. Network equipment repairs demand trust in predictions—wrong parts at a remote cell tower costs days, not hours.

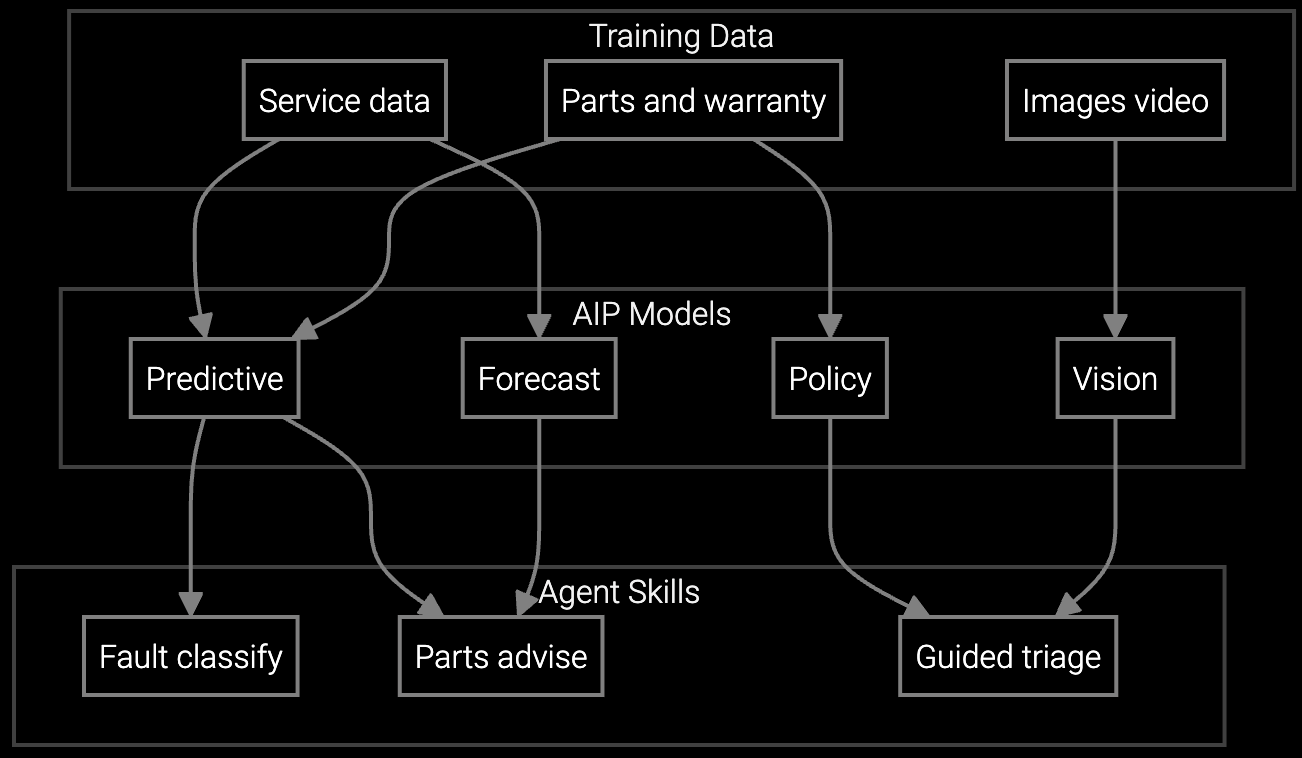

Bruviti's deployment methodology addresses the economic buyer's core concern: proving ROI before organizational disruption. Start with a 30-day pilot targeting one high-volume failure mode—router power supply failures, firewall fan replacements, or optical transceiver swaps. The platform ingests historical work orders, parts consumption logs, and technician debrief notes to build a parts prediction model specific to network equipment failure patterns.

Phase two integrates with existing FSM systems via REST API, augmenting dispatch with predicted parts lists without replacing workflow logic. Technicians receive mobile recommendations ranked by confidence score—preserving their autonomy while reducing missing-parts truck rolls. Measure first-time fix rate improvement weekly. After 90 days, calculate margin impact: fewer repeat visits, lower expedited shipping costs, reduced SLA penalties. Only then expand to additional failure modes or geographies.

Predicts which router power supplies, firewall fans, or optical transceivers technicians need before dispatch to network sites.

Correlates network equipment symptoms with firmware issues, configuration drift, and hardware failure patterns from historical data.

Mobile copilot provides router configuration guidance, firmware rollback procedures, and optical diagnostic steps on-site.

Network equipment field service operates under unique constraints: 24/7 uptime SLAs where a single router failure impacts thousands of business users, remote cell tower sites requiring helicopter access, and firmware complexity where a wrong configuration change causes cascading network failures. These conditions make wrong-parts truck rolls catastrophically expensive—a missing optical transceiver at a remote DWDM node can idle a $2,500/day technician while overnight shipping adds $300 and extends downtime by 18 hours.

AI deployment must account for this operational reality. Start with high-volume, high-cost failure modes where prediction accuracy directly impacts margin: router power supplies (30% of all dispatches), firewall fan assemblies (predictable thermal failures), or optical transceiver degradation (detectable via telemetry). These use cases prove ROI fast because MTTR reductions translate immediately to SLA compliance and lower penalty exposure.

Network equipment OEMs typically see measurable first-time fix improvement within 90 days when starting with a single high-volume failure mode. The pilot phase runs 30 days to train models on historical work orders and parts consumption data. Integration with FSM systems takes another 30 days. By day 90, first-time fix rate improvements of 15-20% are common, translating to immediate truck roll cost savings and reduced SLA penalty exposure.

Modern AI platforms integrate via REST API, augmenting dispatch workflows without replacing FSM logic. The AI layer adds predicted parts lists to work orders while preserving technician scheduling, route optimization, and mobile app interfaces. Network equipment OEMs avoid the $400K+ cost and 12-month timeline of FSM system replacement. Integration testing typically takes 4-6 weeks to ensure parts predictions sync correctly with dispatch and inventory systems.

Confidence scoring prevents the adoption failure seen when AI overrides technician expertise. Predictions come with accuracy percentages—95% confidence on router power supply predictions based on 500 historical failures, 70% confidence on rare firewall board issues. Technicians keep final authority. This approach achieves 80%+ compliance rates versus 42% non-compliance when AI imposes black-box recommendations. Network equipment repairs demand trust because wrong parts at remote sites cost days in extended downtime.

Start with high-volume, high-cost failures where parts prediction accuracy directly impacts margin. Router power supply failures, firewall cooling fan replacements, and optical transceiver degradation are ideal first targets—failure patterns are consistent, telemetry provides early warning signals, and wrong-parts truck rolls are expensive. Avoid complex multi-component failures or rare edge cases in pilot phase. Once ROI is proven on straightforward use cases, expand to firmware-related issues or configuration drift problems.

Track margin impact metrics that matter to CFO: SLA penalty reduction, expedited shipping cost savings, technician utilization improvement, and warranty reserve accuracy. Network equipment OEMs typically see 12-15% reduction in truck roll costs within six months, 20% fewer overnight parts shipments, and 8-10% improvement in technician productivity as missing-parts delays decrease. Calculate cost per truck roll before and after deployment to quantify margin protection. Downtime cost avoided is the ultimate ROI proof for equipment serving five-nines uptime requirements.

How AI bridges the knowledge gap as experienced technicians retire.

Generative AI solutions for preserving institutional knowledge.

AI-powered parts prediction for higher FTFR.

See how network equipment OEMs prove ROI in 90 days with phased AI deployment.

Schedule Implementation Review